Key Business Points

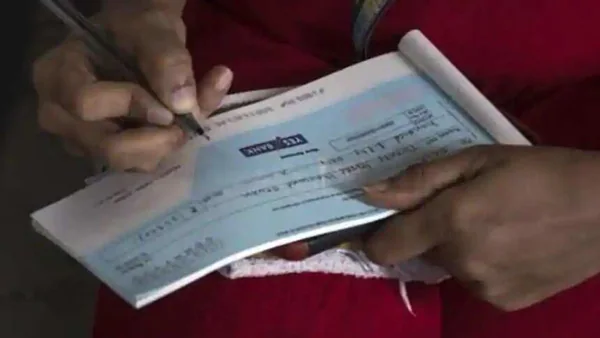

- The Reserve Bank of Malawi (RBM) and Bankers Association of Malawi (BAM) plan to phase out cheque usage by December 2025, aligning with the country’s digital economic drive and reducing fraud incidents.

- Industry players welcome the move, citing delays in high-value cheque payments and the potential for fraudulent transactions, and expect it to modernise the country’s payment infrastructure.

- The phasing out of cheques is expected to improve operational efficiency, enhance safety of payments, and support financial inclusion and digital economy goals, with experts saying it will shift high-value transactions to faster, safer digital rails.

The imminent phasing out of cheques in Malawi has been welcomed by industry players, who say it will solve delays users were facing to clear high-value cheque payments. The Reserve Bank of Malawi (RBM) and Bankers Association of Malawi (BAM) announced that the phasing out of cheque usage will come after the amendment and enactment of the Bills of Exchange (Amendment) Act at the next sitting of Parliament. According to Manufacturers Association of Malawi chairperson Gloria Zimba, cheques have been delaying transactions, especially with high-value payments, as it takes time to have proof of payment. This has created a chigumu (difficulty) for businesses, particularly manufacturers, who rely on timely payments to operate efficiently.

Information and communications technology (ICT) and financial technology (Fintech) experts have also praised the move, saying it aligns well with the country’s uchumi wa dijiti (digital economy) agenda. ICT expert Bram Fudzulani noted that cheques are slow, costly, and incompatible with digital economies, while Fintech expert Arthur Muyepa said the phasing out of cheques will help to kusintha (modernise) the country’s payment infrastructure.

However, Consumers Association of Malawi executive director John Kapito expressed concerns about the quality of digital payment platforms, high charges, and network failures, which have frustrated consumers. Despite these challenges, the benefits of phasing out cheques are clear, including ukweli wa malipo (payment safety) and compliance with national strategic goals of kufikia ufikiaji wa fedha (financial inclusion) and digital economy. As the country moves towards a more digital economy, businesses and individuals must be prepared to adapt to new payment systems and technologies, and take advantage of the opportunities presented by uchumi wa dijiti.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Tourism Boom: A K1 Trillion Opportunity for Business Growth! - March 4, 2026

- Bad Loans Fall: Positive Shift Signals Economic Recovery - March 3, 2026

- Bank Levy Deductions Spark Public Outcry and Economic Debate in Malawi - March 3, 2026