Key Business Points

- Malawi’s Treasury settled mature government securities worth K128.85 billion in the final week of August, addressing mounting pressure on public debt.

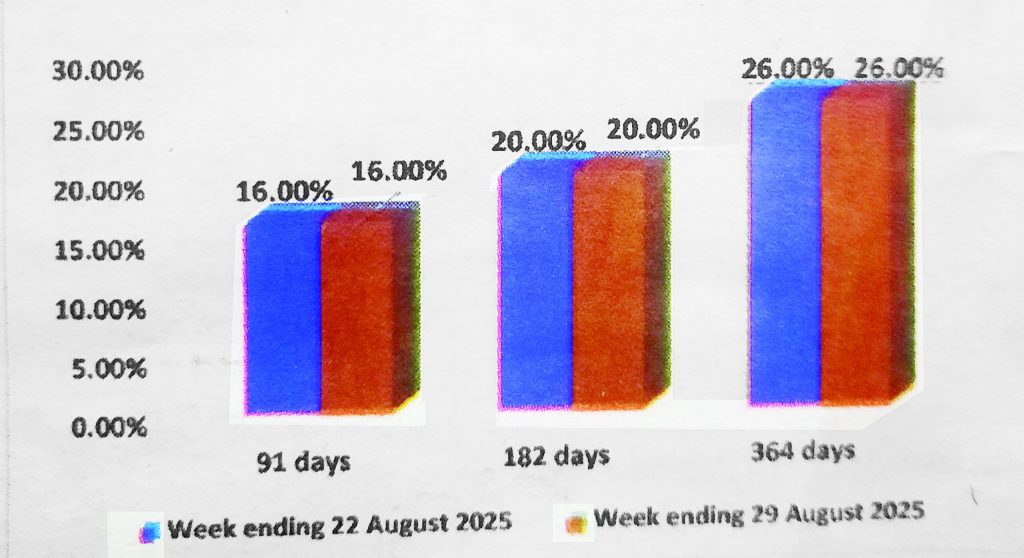

- The Treasury successfully raised K89.6 billion through Treasury bills and Treasury notes, with no rejections during the auctions.

- The move resulted in a net liquidity inflow of K39.25 billion, providing a much-needed boost to the country’s financial market.

As reported by Nico Assets Managers, the Malawian government’s efforts to manage its debt have been ongoing, with a significant focus on settling mature government securities. The recent settlement of K128.85 billion in the final week of August is a crucial step towards alleviating the pressure on public debt. Zokonda za chipulo, or debt management, is a critical aspect of Malawi’s economic strategy, and this move demonstrates the government’s commitment to fiscal responsibility.

The Treasury’s ability to raise K89.6 billion through Treasury bills and Treasury notes is a testament to the country’s mgwirizano wa chipulumuka, or financial stability. The fact that there were no rejections during the auctions suggests a high level of confidence in the government’s ability to manage its debt. This development is expected to have a positive impact on ulanje wa malawi, or Malawi’s economy, as it will help to reduce the burden of debt servicing and free up resources for other critical sectors.

The net liquidity inflow of K39.25 billion resulting from the Treasury’s actions will provide a much-needed boost to the country’s financial market. This influx of liquidity is expected to kuvutika kwa njanji, or stimulate economic growth, by making it easier for businesses to access credit and invest in their operations. As Malawi continues to navigate the challenges of chipulumuka, or economics, the government’s efforts to manage its debt and maintain financial stability will be crucial in attracting investors and promoting mazabulo, or entrepreneurship.

The settlement of mature government securities and the successful raising of funds through Treasury bills and Treasury notes demonstrate the government’s commitment to kudutsa za chipulumuka, or improving the economy. As the country looks to the future, it is essential for businesses and entrepreneurs to stay informed about developments in the financial market and take advantage of opportunities as they arise. With the government’s focus on debt management and financial stability, Malawi’s business community can look forward to a more stable and predictable economic environment, which will be critical in driving growth and investment in the years to come.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026