Key Business Points

- The kwacha is projected to weaken further between 2026 and 2029, with the Economist Intelligence Unit (EIU) forecasting a depreciation to K2,438 against the dollar in 2026 and K3,250 by the end of 2029.

- Exchange rate flexibility will be allowed by the central bank, reflecting the low foreign exchange reserves, which are forecast to remain at an average of 0.9 months of import cover in 2025-26.

- Inflation pressure is expected to increase due to the depreciation of the kwacha, with the Economics Association of Malawi president noting that imported inflation will exacerbate the cost of living crisis, as Malawi is a net importer.

The Economist Intelligence Unit (EIU) has projected that the kwacha will depreciate gradually over the forecast period, reflecting the paucity of foreign exchange reserves. This comes at a time when the government is discussing a potential new program with the International Monetary Fund (IMF), which automatically terminated the Extended Credit Facility (ECF) in May this year. The EIU describes the spread between the official rate of K1,751 and the parallel rate of K3,500 as huge, indicating a significant disparity between the two rates.

According to the EIU report, exchange rate flexibility will be allowed by the central bank, reflecting the low foreign exchange reserves, which are forecast to remain at an average of 0.9 months of import cover in 2025-26. This will lead to a depreciation of the kwacha to K2,438 against the dollar in 2026 and K3,250 by the end of 2029. By 2029, the kwacha will be trading close to its fair value, with a narrower spread between the official and parallel market rates, reflecting the achievement of the policy goal of exchange rate flexibility, coupled with lower inflation.

Reserve Bank of Malawi (RBM) spokesperson Boston Maliketi Banda stated that discussions with the IMF have just commenced to achieve macroeconomic stability, and the devaluation topic is not involved. He emphasized that every step will be carefully analyzed to ensure that it benefits the economy. University of Malawi economics lecturer Edward Leman highlighted the need to solve the economy’s underlying structural challenges, such as lack of production and exports. He noted that the presence of a wide parallel-market premium further complicates the situation, making the kwacha appear overvalued relative to market conditions.

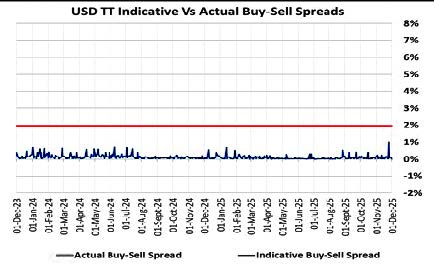

Financial Market Dealers Association president Leslie Fatch noted that there is continued pressure on the local unit due to a backlog on import bills coupled with the limited foreign exchange supply. He emphasized the importance of the forex auctions in providing a mechanism for flexibility, which would allow the exchange rate to move in response to market forces. Economics Association of Malawi president Bertha Bangara-Chikadza earlier stated that the projected direction of the kwacha will exert extra pressure on inflation, considering that Malawi is a net importer. As a result, despite easing food prices, non-food inflation may dampen the inflation outlook in the near-term.

In the context of Malawi’s economy, the projected depreciation of the kwacha will have significant implications for businesses and entrepreneurs. As the kwacha weakens, import costs will increase, leading to higher prices for goods and services. This will affect consumers and producers alike, making it essential for businesses to mitigate the risks associated with currency fluctuations. Additionally, the government’s discussions with the IMF will be crucial in determining the future of Malawi’s economy, and businesses should stay informed about the developments in this regard. By understanding the changers and challenges facing the economy, businesses can make informed decisions and adjust their strategies accordingly. As the Malawian proverb goes, "Kusaka mkono si kudya" (waiting for someone to give you a hand is not the same as eating), businesses must take proactive steps to navigate the changing economic landscape and thriving in the face of uncertainty.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Powering Malawi’s Growth: Key Standards for Industrial Takeoff - January 25, 2026

- Revitalizing Malawi’s Economy: Enhancing Nasfam’s Subsidy Programme for Sustainable Growth - January 24, 2026

- Driving Malawi’s Growth: Strategic Leadership for a Thriving Economy - January 24, 2026