Key Business Points

- The Reserve Bank of Malawi (RBM) may lower the policy rate if inflation continues to decrease, driven by easing food prices, which could lead to reduced interest rates for businesses and individuals.

- Food prices, particularly maize, have declined by six percent in November, contributing to a drop in inflation rate from 29.1 percent to 27.9 percent, and are expected to continue decreasing due to improved food availability.

- Winter cropping initiatives and addressing underlying food pressures are crucial for long-term stability and economic growth, as highlighted by experts, including Economics Association of Malawi president Bertha Bangara-Chikadza, who emphasizes the need to strengthen winter cropping to ensure increased annual production and supply.

The Reserve Bank of Malawi (RBM) has hinted at a possible downward revision of the policy rate if inflation continues to decelerate due to easing food prices. According to RBM Deputy Governor for economics and regulation Kisu Simwaka, the easing of inflation, which followed a drop in maize prices by six percent in November, looks set to continue and could prompt the central bank to lower the policy rate. This would be a significant development for Malawi’s business community, as it could lead to reduced interest rates and increased access to credit for businesses and individuals.

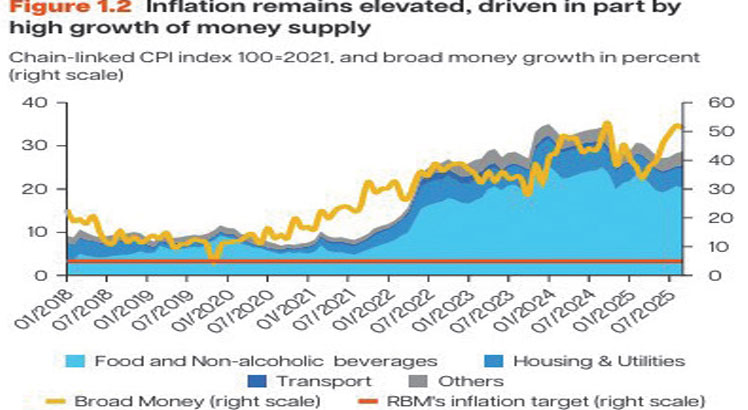

The decline in food prices, particularly maize, has been a major contributor to the drop in inflation rate from 29.1 percent to 27.9 percent. The International Food Policy Research Institute maize price monthly report indicated that the grain’s average retail price dropped by six percent in November, with prices declining more in the Southern and Central regions. This trend is expected to continue, with Simwaka projecting a further decline in the inflation rate due to the stabilization of food prices supported by improved food availability.

Experts, including Economics Association of Malawi president Bertha Bangara-Chikadza, have emphasized the need to address underlying food pressures to ensure long-term stability and economic growth. Bangara-Chikadza highlighted the importance of winter cropping initiatives to increase annual production and supply, saying "while non-food inflation has remained relatively stable, the persistently high headline inflation trends suggest that the country must address the underlying food pressures." Centre for Social Concern programme officer for economic governance Agnes Nyirongo also noted that transport costs have been volatile due to foreign exchange scarcity, which can stifle business growth.

The Monetary Policy Committee of the RBM has kept the policy rate at 26 percent, with commercial banks’ lending rates at as high as 37 percent due to inflationary pressures. However, if the current trend continues, the RBM may consider lowering the policy rate, which could have a positive impact on Malawi’s economy and business sector. As Simwaka noted, "if inflation continues to decline, supported by encouraging macroeconomic data, it could be perfectly reasonable to reduce interest rates." This development is worth monitoring for businesses and entrepreneurs, as it could lead to increased access to credit and new investment opportunities.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026