Key Business Points

- Malawi’s foreign direct investment (FDI) stands at $220 million, lagging behind regional peers such as South Africa, Tanzania, Zambia, and Zimbabwe, due to a hostile business climate for investors.

- Narrow investment base, macro-economic volatility, foreign exchange scarcity, and policy incoherence are major deterrents for potential investors, leading to a limited transfer of skills and technology.

- The country’s foreign currency shortages and unpredictable economic environment have driven investors to seek more stable opportunities in neighboring countries, hindering long-term growth and FDI.

Malawi’s struggle to attract foreign direct investment (FDI) continues, with the country recording a mere $220 million in 2024, according to African Export-Import Bank (Afreximbank) data. This figure is significantly lower than that of its regional peers, including South Africa, Tanzania, Zambia, and Zimbabwe. Economist Paul Kwengwere attributes this to a hostile business climate, citing a narrow investment base, macro-economic volatility, foreign exchange scarcity, and policy incoherence as major deterrents for potential investors. The scarcity of foreign exchange, in particular, creates a repatriation risk, making it difficult for investors to convert their profits into US dollars to pay dividends, repay external loans, or purchase raw materials.

The Malawi Investment and Trade Centre has been working to improve the business environment, operating a one-stop service centre and providing after-care services to investors. However, despite these efforts, the country’s FDI inflows remain below the 10-year average, with fundamentals remaining less attractive to investors compared to its peers. The Export Development Fund notes that the lack of consistent FDI inflows into Malawi is partly due to the limited pipeline of bankable, investment-ready projects in sectors with strong export potential.

The United Nations Conference on Trade and Development secretary general, Rebecca Grynspan, observes that geo-economic fragmentation is reshaping the global investment landscape, creating both obstacles and opportunities for countries to participate in the global economy. Malawi’s limited participation in regional value chains and negative perceptions among investors have perpetuated its struggles to attract FDI. As Daisy Kambalame, CEO of the Malawi Confederation of Chambers of Commerce and Industry, notes, foreign currency shortages and an unpredictable economic environment have driven investors to seek more stable opportunities in neighboring countries.

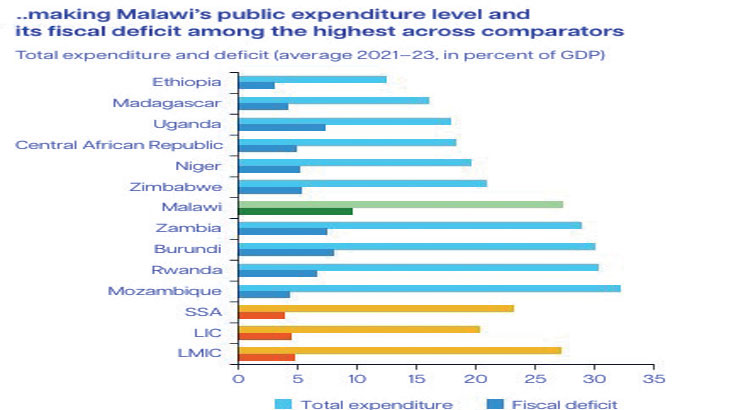

To address these challenges, Malawi must focus on reforming its business climate, diversifying its investment base, and improving its infrastructure to make it more attractive to investors. The government’s efforts to woo FDI through investment foras are a step in the right direction, but more needs to be done to address the underlying issues deterring investors. As the World Bank notes, Malawi has one of the lowest investment rates in the region, highlighting the need for urgent action to boost FDI and drive economic growth. In Chichewa, this is often referred to as "kugwira ntchito kuipaumphata", or working to improve the business environment. By doing so, Malawi can create a more favorable climate for investment, "kulemera kuzomangitsa", or attracting more investors to the country.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Business Pulse: Falling Interest Rates Open New Avenues for Growth - February 8, 2026

- Malawi’s Growing Trade Gap: Key Challenges and Opportunities for Business Strategy - February 8, 2026

- Social Protection Funding Gap Hampers Malawi’s Economic Growth—Analysis - February 7, 2026