Key Business Points

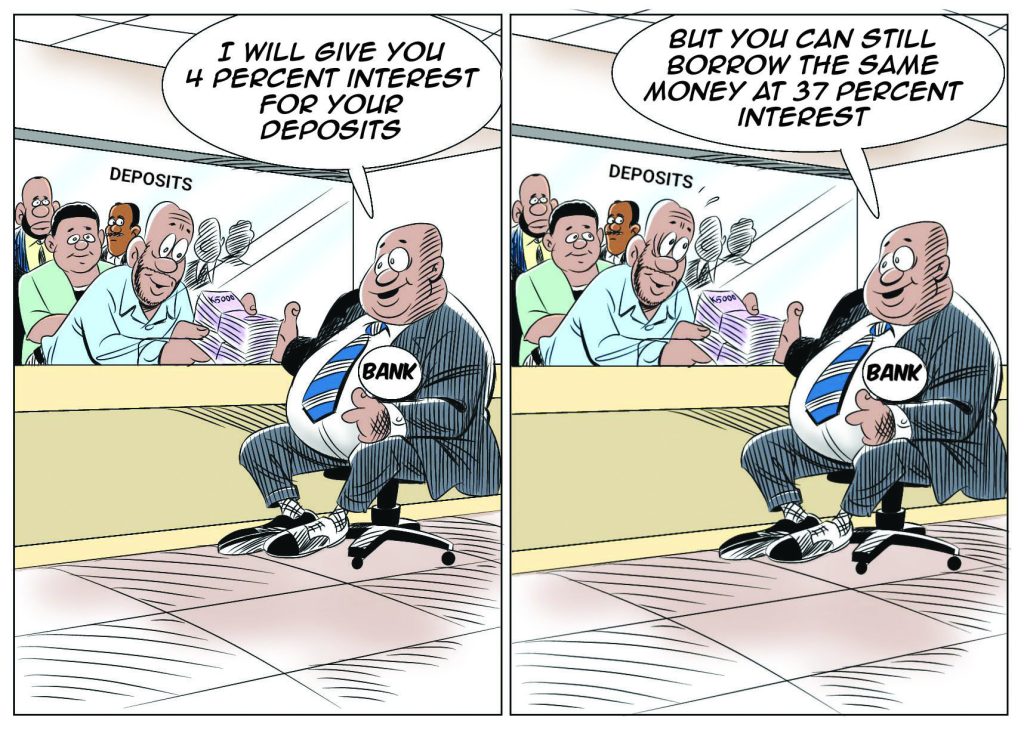

- Interest rate spread in Malawi is alarmingly high, with a gap of 33 percentage points between lending and deposit rates, affecting businesses and individuals who rely on borrowing to grow.

- High lending rates are stifling economic growth, making it difficult for small and medium enterprises to access credit, and limiting private sector investment and job creation.

- Reform is necessary to address the issue, with stakeholders calling for a reduction in the cost of borrowing, increased competition in the banking sector, and improved savings mobilization to build a more resilient and inclusive financial system.

Malawi’s business community is facing significant challenges due to the extremely wide interest rate spread in the country. The story of Jarson Phiri, a young man who had to postpone his studies due to unforeseen challenges, highlights the issue. Phiri had saved K1 million, which he placed in a bank savings account, but the interest earned was only K40,000, around 4.27 percent. When he approached the bank for a loan, he was shocked to find that the interest rate would be around 38 percent per annum. This experience is not unique, as many individuals and businesses in Malawi are struggling with the high interest rate spread.

The interest rate spread in Malawi is one of the widest in the region, with lending rates standing at 37.27 percent and deposit rates at 4.27 percent. This disparity has become a conduit for wealth extraction, enabling banks to post massive profits at the expense of ordinary Malawians. Finance Minister Joseph Mwanamvekha has raised concerns about the impact of high lending rates on businesses, questioning what type of business can realistically operate and make a profit in such conditions.

The Bankers Association of Malawi attributes the gap to a complex mix of high operating costs, risk premiums, regulatory requirements, inflation, government borrowing, and monetary policy. However, Consumers Association of Malawi Executive Director John Kapito argues that the extreme disparity is a deliberate attempt to widen the gap between the rich and the poor, discouraging people from borrowing and building their businesses.

Economics Association of Malawi President Bertha Bangala Chikadza situates the issue within a broader macroeconomic framework, arguing that the 33-percentage-point interest rate spread reflects deep structural and macroeconomic frictions in a high-risk environment. Financial analyst Ferdinand Mchacha warns that unattractive savings rates are hollowing out the formal banking system, depriving banks of cheap capital that could fuel private-sector growth.

The long-term implications of a 33 percent interest rate spread are stark, according to Scotland-based economist Velli Nyirongo. It discourages saving and investment, limits private sector investment, stifles innovation, and slows job creation. It also worsens inequality and financial exclusion, increases the cost of doing business, and fuels inflationary pressures. Nyirongo concludes that a persistently wide interest rate spread signals deeper structural and policy failures, ranging from excessive government borrowing and weak competition to macroeconomic instability.

For Malawians like Jarson Phiri, these are not abstract economic theories, but lived realities, felt in stalled ambitions, deferred dreams, and a banking system that too often appears indifferent to the very people it was meant to serve. As Kapito would say, "Izi ndi mfundo ya kuwongola" – this is a matter of exploitation. The need for reform is urgent, and stakeholders must work together to address the issue and build a more resilient, inclusive, and competitive financial system that benefits both savers and borrowers. Kufika pa nkhani, the story of Jarson Phiri serves as a reminder of the need for a more equitable and just financial system in Malawi.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Making Social Insurance Work for Malawi’s Business Community - March 1, 2026

- Unlocking Malawi’s Trade Potential: K411 Billion in Barriers Explained - February 28, 2026

- Malawi Secures K75bn Chinese Grant for Landmark Dual Carriageway - February 28, 2026