Key Business Points

- Tax revenue growth in Malawi has been hindered by frequent increases to the tax-free threshold, with the World Bank noting that this has resulted in revenues remaining far below the level needed to fund public services.

- Expansion of revenue sources is essential to address the issue, with the World Bank suggesting that reducing value added tax (VAT) exemptions could help stabilize revenue and allow for automatic inflation adjustment of personal income tax thresholds.

- Pay As You Earn (Paye) system reforms are necessary to ensure that the tax base is broadened and that wealthier individuals are contributing their fair share, with the current system placing a disproportionate burden on middle-income earners.

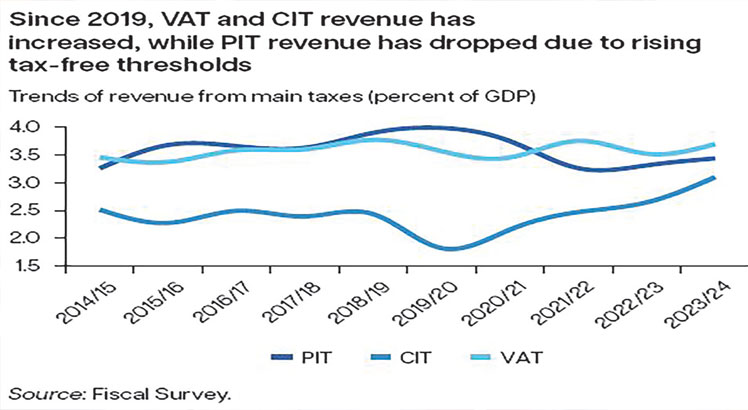

The World Bank has warned that Malawi’s tax revenue has been weakened by frequent increases to the tax-free threshold, resulting in revenues that are far below the level needed to fund public services. According to the World Bank, the tax-free threshold has been increased significantly over the past few years, with the threshold rising from K35 000 to K45 000 in 2019, and then jumping by 120 percent to K100 000 in 2020. This has resulted in a narrowing of the tax base, with the 15 percent middle tax bracket being eliminated.

The World Bank notes that Malawi’s Paye system offers one of Africa’s most generous tax-free thresholds relative to GDP per capita. While the system reflects a strong commitment to protecting low-income earners, it also means that a substantial portion of income is shielded from taxation. The bank suggests that expanding revenue sources, such as reducing VAT exemptions, is essential to address this issue. Once revenue stabilizes, automatic inflation adjustment of personal income tax thresholds would improve system consistency.

Economist Bond Mtembezeka agrees that there is a need to align the tax-free band to the cost of living realities on the ground. He notes that the current tax-free band of K170 000 is way lower than the average cost of living of around K800 000, according to statistics produced by the Centre for Social Concern. This means that people’s livelihoods have not been made any better, despite the increases to the tax-free threshold.

The Economics Association of Malawi has observed that the higher Paye rates for middle and high-income earners could help cover part of the deficit and potentially increase total Paye collections. Under the new tax regime, the zero Paye bracket has increased from K150 000 to K170 000, while those earning between K170 000 and K1.57 million will be taxed at 30 percent, up from 25 percent. Earners of up to K10 million will be taxed at 35 percent, while those earning beyond K10 million will face a 40 percent tax.

Overall, the World Bank’s analysis highlights the need for reform of Malawi’s tax system to ensure that it is fair, efficient, and effective in raising revenue. This includes broadening the tax base, reducing VAT exemptions, and aligning the tax-free band to the cost of living realities on the ground. As bondani achifukwa (business owners) in Malawi, it is essential to understand the implications of these reforms and to kulimbikitsa (invest) in initiatives that promote economic growth and development.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026