Key Business Points

- The Malawi Stock Exchange (MSE) has started 2026 on a low note, with the Malawi All Share Index (Masi) dropping by 0.1 percent, attributed to a continuation of the 2025 share price correction.

- The introduction of capital gains tax is discouraging long-term investment and causing uncertainty among investors, leading to a cautious approach in the market.

- Stock market analysts advise viewing the current market movements as a healthy correction, allowing prices to realign with underlying fundamentals, and encourage investors to take a long-term perspective.

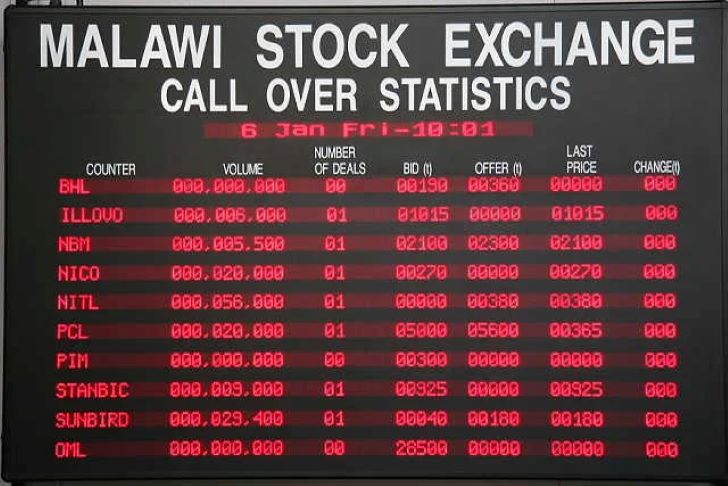

The Malawi Stock Exchange (MSE) has begun the year 2026 with a decline in the Malawi All Share Index (Masi), dropping by 0.1 percent. This development is seen as a continuation of the share price correction that occurred in 2025. According to MSE data for the week ending January 9, the Malawi All Share Index dropped from 597 219.78 points to 598 062.8 points, with seven companies registering share price losses. Stockbrokers Malawi Limited equity investment analyst Kondwani Makwakwa notes that the introduction of capital gains tax has led to a cautious approach among investors, in addition to the share price correction.

The market data shows that seven counters in the banking and telecoms sectors registered share price losses, while seven others gained, and two remained steady. Minority Shareholders Association of Listed Companies secretary general Frank Harawa attributes the subdued performance to the introduction of capital gains tax, which is discouraging long-term investment. Stock market investor Brian Kampanje also notes that retail investors’ confidence is waning due to the uncertainty surrounding the capital gains tax. As Kondwani Makwakwa advises, investors should view the current market movements as a healthy correction, allowing prices to realign with underlying fundamentals.

The capital gains tax, introduced in the Mid-Year Budget, will now apply to all share disposals, regardless of the length of time they have been held. This is a significant change from the past, where shares held for more than one year were exempt from tax. Stock market investor Purity Chitaro cautions that while the recent decline is concerning, it is essential to note that share investments are long-term. As zinthu zina zigulisa kwa tsogolo, or "things that bring wealth in the future," investors should consider taking a long-term perspective and not making hasty decisions based on short-term market fluctuations. With this in mind, investors can navigate the current market conditions and make informed decisions to achieve their financial goals.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Graphite Gateway: US Partnership Powers Opportunities - February 28, 2026

- Illovo Urges Forex Reforms to Fuel Malawi’s Economic Growth - February 28, 2026

- Lotus Saves K25bn with Landmark Grid Connection Deal - February 27, 2026