Key Business Points

- The Reserve Bank of Malawi (RBM) has introduced a new directive to strengthen oversight of life insurance and pension fund administration, allowing for offshore investment and promoting diversification.

- The directive requires life insurers and pension fund managers to develop an investment policy and enter into written investment management agreements with managers, ensuring prudent management and safeguarding of funds.

- The move is expected to unlock diversification opportunities, support infrastructure development, and contribute to Malawi’s economic growth, with offshore investment limited to securities of governments in Comesa and Sadc countries, promoting zinthu zilizo katika ngodya muno (things within our region).

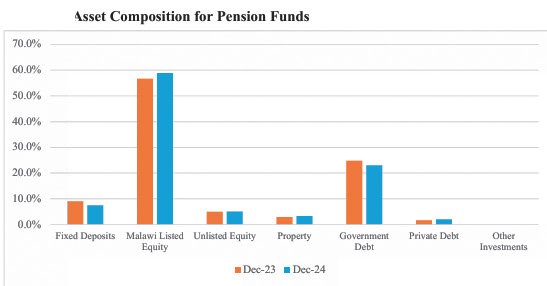

The Reserve Bank of Malawi (RBM) has issued a directive to strengthen oversight of life insurance and pension fund administration, allowing offshore investment to unlock diversification and safeguard the funds. The new Financial Services (Investment Management of Life Insurers and Pension Funds) Directive of 2025 will apply to life insurers and pension fund managers, promoting prudent management and diversification of investments. This move comes at a time when the pension fund has grown to K3.8 trillion, with an increasing need for strong oversight and diversification of investment avenues.

According to the directive, life insurance firms and pension fund managers will be required to develop an investment policy in line with the move, which will consider issues such as avoiding undue concentration of investments. The directive also requires life insurers and pension fund managers to enter into written investment management agreements with managers, clearly setting out terms, fees, and performance measurement. Kutengana ndi mabizinesi (doing business) will become more secure and trustworthy with these new regulations.

Industry experts have welcomed the directive, describing it as a milestone that will create value by unlocking diversification and supporting the country’s investment structure. Lilian Moyo, president of the Life and Pensions Association of Malawi, said the directive will promote prudent investment practices, open opportunities for regional diversification, and support infrastructure development. Brian Kampanje, a finance expert, noted that the directive limits the contagion risk as a result of potential problems in one sector of the economy, which will lead to more ziweto zilizotengenzeka (available shares) for trading.

The directive also allows for offshore investment, but limited to securities of governments in Comesa and Sadc countries, which will promote regional diversification. This move is expected to contribute to Malawi’s economic growth, while safeguarding pensioners’ and policyholders’ savings. Misheck Esau, CEO of Nico Capital Limited, said the directive has the potential to transform the country’s financial sector, while Eric Chapola, atered insurer, noted that it will ensure owners of the funds are well-regulated to guarantee safety. With these new developments, mazabwana a zinthu (business owners) can look forward to a more secure and promising future.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Tourism Boom: A K1 Trillion Opportunity for Business Growth! - March 4, 2026

- Bad Loans Fall: Positive Shift Signals Economic Recovery - March 3, 2026

- Bank Levy Deductions Spark Public Outcry and Economic Debate in Malawi - March 3, 2026