Elevating Malawi’s Economic Resilience: Harnessing Opportunities Amidst Shifting Social Protection Trends

Key Business Points

- Eroding purchasing power: Malawi’s social cash transfer value has decreased by 25% to roughly K12,300 in real terms, affecting poor and vulnerable households, particularly women and children.

- Sustainability risks: The social protection financing in Malawi faces significant sustainability risks due to mounting fiscal pressures and an anticipated dramatic reduction in donor funding, emphasizing the need for a Social Protection Financing Strategy to guide long-term financing.

- Diversifying resources: The government must explore ways to mobilize and diversify resources, including Kuvwira ntchito za mikanda (private sector participation), to ensure the sustainability of social protection programmes and promote mtendere wa ufumu (economic growth).

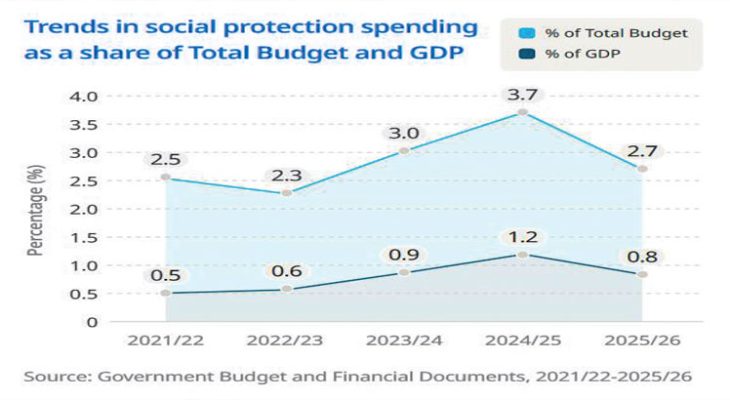

The United Nations has warned that macro-fiscal challenges, including high inflation and exchange rate pressures, are threatening the gains made in Malawi’s social protection system. The 2025/26 Social Protection Budget Brief published by Unicef reveals that allocations to on-budget social protection programmes have declined by 3% from K224 billion in 2024/25 to K217 billion in the current fiscal year. In real terms, the budget has declined by 20% due to a projected annual average inflation of 22.3%. This decline undermines the well-being of poor and vulnerable households, especially women and children, and weakens household resilience.

Unicef encourages the government to safeguard the purchasing power of cash transfers by pegging the transfer amounts to inflation and exploring indexation mechanisms. The government has recently committed to taking on four additional districts during the 2025/26 fiscal year, increasing its contribution to the social cash transfer programme budget from 5% to at least 15%. However, with over 95% of the programme funded by donors, the evolving donor landscape poses significant sustainability risks. Some donors, such as the World Bank, are signaling a major reduction in funding, which may require a significant scaling down of the programme from 2027.

Governance expert Lingalireni Mihowa notes that the economy is in distress, with limited fiscal space for government allocations to social protection programmes. She emphasizes the need to accelerate efforts on implementation of the agriculture, tourism, mining, and manufacturing (ATM+M) strategy to grow the economy, create a conducive environment for the private sector to thrive, and drive economic growth. Investments in productive social protection programmes can help address inequalities in the long run.

The Social Cash Transfer Programme currently covers only 10% of the population, despite 20.5% living in ultra-poverty. Other programmes cover approximately 11% of households across Malawi. To address these challenges!-wiseMalawi Government, with technical support from Unicef, is developing a Social Protection Financing Strategy to guide long-term, sustainable financing for social protection. This strategy will provide a set of feasible and context-specific options for the government to mobilize and diversify resources, particularly in light of declining donor contributions. By exploring Kuwezesha ufndo (resource mobilization) and Kuwalenga sera (policy alignment), the government can ensure the sustainability of social protection programmes, ultimately promoting kuwala kwa maisha (improved livelihoods) and mtendere wa ufumu (economic growth) in Malawi.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Airtel Money Africa Drives Digital Payments Growth for Malawian Businesses - March 5, 2026

- Banks Urged to Diversify Lending for Economic Growth - March 5, 2026

- Montepuez Ruby Mining: A Catalyst for Economic Growth in Malawi - March 5, 2026