Navigating Malawi’s Fiscal Storm: Strategies for Business Resilience and Growth

Key Business Points

- Fiscal deficits and inflation are major concerns for Malawi’s economy, with the World Bank warning of a widening fiscal deficit to 12.6 percent of GDP in 2025, the highest in southern Africa.

- Debt servicing is consuming nearly 40 percent of domestic revenue, crowding out development expenditure and private-sector credit, leaving limited fiscal space for productive investment, a situation that can be described as "kugonja kwa chipongwe" (a tight squeeze).

- Diversification of exports is crucial for Malawi’s economic stability, with economists urging a shift towards higher-value exports such as horticulture, agro-processing, and niche manufacturing to reduce reliance on tobacco, which is experiencing declining global demand.

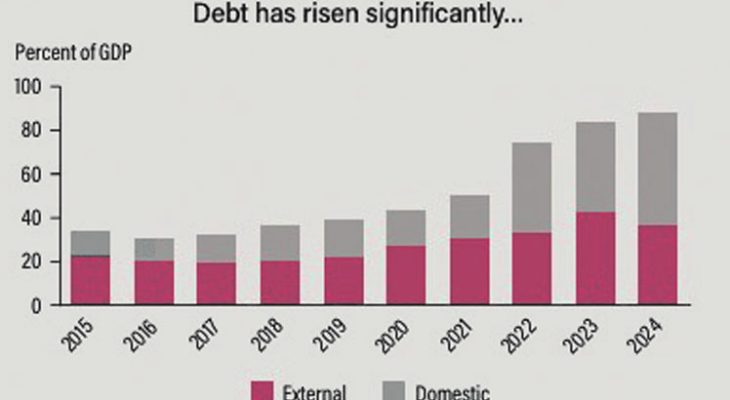

Malawi’s economic stability remains under intense strain, with the latest World Bank assessment warning of persistent fiscal deficits, rising inflation, and chronic foreign exchange shortages fuelling macroeconomic crises. The World Bank’s Macro Poverty Outlook projects that the fiscal deficit will widen further, driven by election-related spending, weak revenue mobilisation, and mounting debt repayments. Total public debt has exceeded 90 percent of GDP, the highest since the pre-Heavily Indebted Poor Countries (Hipc) era, while inflation remains elevated at 28.7 percent.

The report notes that fiscal overruns, weak oversight, and unsustainable domestic borrowing have driven debt-service obligations to consume nearly 40 percent of domestic revenue projected at K4.4 trillion this fiscal year. This situation is described as "zinthu zikugwiritsa ntchito" (things are getting out of hand) by economists, who warn that if current trends persist, the fiscal deficit could rise to 13.3 percent of GDP in 2026, further elevating debt-servicing costs and increasing reliance on costly domestic borrowing.

Inflation is expected to remain high up to next year, driven by rising food and fuel prices and a rapid expansion of money supply, which grew by 49 percent in July 2025 alone. Gross official reserves remain below one month of import cover, while per capita income has declined for the fourth consecutive year. Economists say these trends reflect a deep-seated structural crisis rather than short-term shocks, which can be described as "mvana wa chipongwe" (a problem that is difficult to solve).

The Centre for Social Concern (CfSC) economic governance officer, Agnes Nyirongo, warned that political spending and weak fiscal control mechanisms are aggravating Malawi’s financial distress. She said the widening fiscal deficit reflects a recurring pattern of election-period overspending and institutional fragility, which is a "chikhulupiliro cha mgwirizano" (a challenge to stability). Economist Gilbert Kachamba said the widening trade deficit and declining reserves "present a serious threat to macroeconomic stability in the short to medium-term".

With total forex reserves now covering only 2.1 months of imports, Kachamba warned that Malawi faces heightened vulnerability to external shocks, including fuel price volatility and exchange-rate pressures. He emphasized the need for a strategic shift towards diversified, higher-value exports to reduce reliance on tobacco and improve competitiveness, which is essential for "kujilimbikitsa" (to be self-sufficient). The Ministry of Finance, Economic Planning and Development data show a cumulative deficit of K1.03 trillion between April and August this year, which is equivalent to almost half of total government revenue over the same period. The CfSC has urged authorities to curb runaway deficits, enforce spending limits, and fully implement the Integrated Financial Management Information System to address the country’s financial distress, a move that is seen as "kugwira ntchito" (taking action) to stabilize the economy.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026

- Navigating Malawi’s Fiscal Crossroads: Strategies for Business Resilience Amidst Rising Debt - January 29, 2026

- ACE Africa Taps Seasoned Expert Muona to Spearhead Growth and Drive Business Momentum in Malawi - January 29, 2026