Reshaping Malawi’s Financial Landscape: A New Debt Restructuring Proposal Raises Stakes for Local Banks

Key Business Points

- Debt restructuring is being considered by the government to address Malawi’s unsustainable domestic debt of K21.6 trillion, with a focus on reducing debt service costs that are expected to reach K2.2 trillion this year.

- Commercial banks are cautious about the proposal, warning that it could destabilize the financial services sector, while others argue that shared pain is necessary for economic recovery, using the Chichewa phrase "kugwiritsa ntchito masapondo" (to utilize resources efficiently).

- Economic experts recommend a gradual approach with expenditure cuts, fiscal discipline, and accountability to optimize resource utilization and create fiscal space, as emphasized by the concept of "kukhazikitsa zipatso" (to prioritize expenses).

The Malawian government is considering restructuring its domestic debt, which has reached unsustainable levels, with much of the K21.6 trillion owed to local creditors. The domestic debt has quick maturities and high interest rates, piling pressure on the fiscal space. Finance Minister Joseph Mwanamvekha has appealed to players in the financial sector to take the debt restructuring proposal positively, considering the prevailing economic situation. University of Malawi Economics Professor Winford Masanjala emphasized that domestic debt restructuring is necessary for economic recovery and stability, and that reforms may bring pain. He cited scenarios where the government had to hold paying arrears to the business sector as a relief measure that had worked before, highlighting the importance of kutenga masapondo (to allocate resources efficiently).

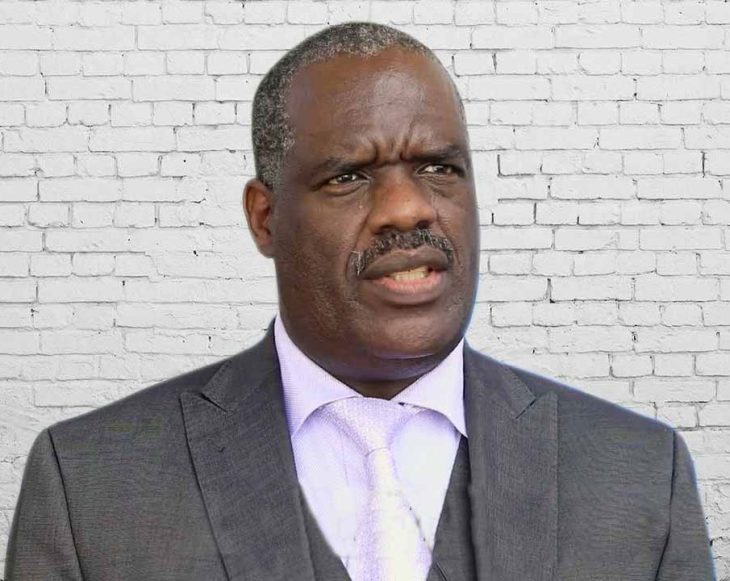

However, Bankers Association of Malawi President Phillip Madinga cautioned that the idea could destabilize the financial services sector, which has supported the sustenance of the economy. He noted that the domestic public debt concerns not just commercial banks but the broader spectrum of the financial sector, including pension money and insurance resources invested in Treasury bills and Treasury notes. Madinga suggested a gradual approach with interventions that minimize shocks, urging the authorities to ensure expenditure cuts, fiscal discipline, and accountability to optimize resource utilization. He also emphasized the need for the financial sector to shift its attention towards a productive industry that has suffered low financing, promoting kugwiritsa ntchito mwayi (to utilize resources productively).

The government is struggling to secure debt restructuring deals with foreign commercial creditors after some bilateral and multilateral creditors already provided relief. As the situation unfolds, Malawian businesses and entrepreneurs should be aware of the potential implications of debt restructuring on the economy and the financial sector, and consider the opportunities for kuvina biwi (to seize opportunities) in a restructured economy. With a focus on kutengera kwa chipongwe (to move forward together), the government, financial sector, and businesses can work together to achieve economic recovery and stability.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- ACE Africa Taps Seasoned Expert Muona to Spearhead Growth and Drive Business Momentum in Malawi - January 29, 2026

- Navigating Turbulence: How Fuel Price Volatility Impacts Malawi’s Business Landscape - January 29, 2026

- Malawi’s Corporate Giants Surge: Record K1.5tn Profit Fuels Economic Growth - January 29, 2026