Revitalizing Malawi’s Economy: Overcoming Distortions for Sustainable Growth and Prosperity

Key Business Points

- Improving corporate governance in State Owned Enterprises (SOEs) is crucial to harness their revenue potential and reduce their burden on the treasury, as emphasized by experts in a panel discussion.

- Reversing implicit subsidies and unjustifiable tax exemptions is necessary to ensure a credible reform position and drive economic stability and recovery, as highlighted in the World Bank report on Public Finance Review.

- Increasing accountability in public finance management is essential to prevent abuse of resources and promote economic growth, with experts suggesting that the budget should be treated as a law and violators held accountable, as argued by Economics Professor Winford Masanjala.

The Malawian economy is facing significant challenges, with the State Owned Enterprises (SOEs) sector experiencing a substantial decline in performance, from a combined profit of K543 billion in 2023 to a K47.6 billion loss in 2024. This downturn is mainly attributed to the water and energy sectors, and is a result of government-imposed distortions in the management of SOEs. According to the World Bank report on Public Finance Review, these distortions have led to serious breaches in management of public resources and the economy, from both fiscal and monetary policy positions.

Experts have emphasized the need for a big push to recover from the current economic situation, which includes improving corporate governance in SOEs to unlock their revenue potential and contribution to industrialization. This is in line with the Chichewa business term "kugwira ntchito kwambiri," which means working hard and efficiently to achieve economic growth. Additionally, reversing implicit subsidies and unjustifiable tax exemptions is necessary to ensure a credible reform position and drive economic stability and recovery.

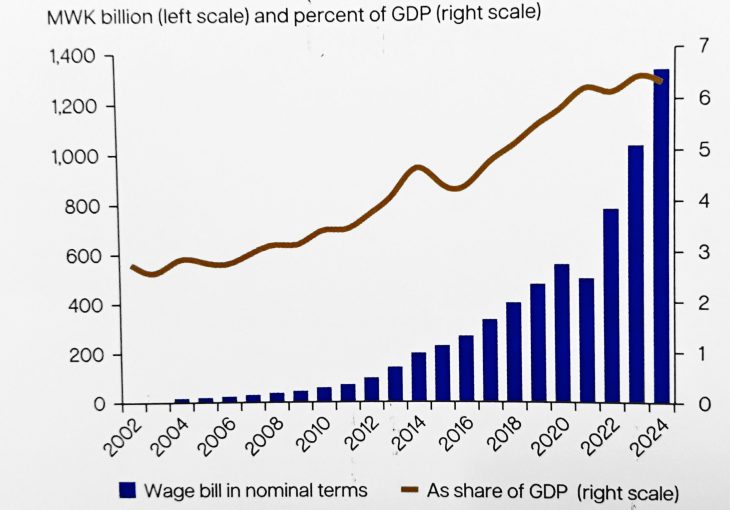

The country’s revenue increase from 4 percent to 15 percent of GDP has not improved fiscal balance, as high spending has widened deficits to an average 11.9 percent over the past three years. Furthermore, monetary policy distortions have cost the Reserve Bank of Malawi (RBM) significantly, with losses of K708.7 billion in 2023 and K200.4 billion in 2022. The country is now heavily reliant on foreign support to finance development projects, with over 90 percent of domestic revenue going towards statutory expenditures like wages and debt service costs.

Experts have isolated lack of accountability in public finance management as a driver of abuse of resources, with Economics Professor Winford Masanjala arguing that the budget should be treated as a law and violators held accountable. Another economist, Taz Chaponda, emphasized the need for a cocktail of interventions to chart the way forward and unlock foreign financing to stabilize the foreign reserve situation and achieve economic recovery. The World Bank has provided recovery scenarios, including a big push, gradual approach, or maintaining the status quo, and it is up to the people of Malawi to decide which path to take, as stated by World Bank country manager Firaz Raad. As Malawian business owners and entrepreneurs consider these options, they can reflect on the Chichewa phrase "tithandize mawu," which means working together to achieve a common goal, in this case, economic recovery and growth.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- ACE Africa Taps Seasoned Expert Muona to Spearhead Growth and Drive Business Momentum in Malawi - January 29, 2026

- Navigating Turbulence: How Fuel Price Volatility Impacts Malawi’s Business Landscape - January 29, 2026

- Malawi’s Corporate Giants Surge: Record K1.5tn Profit Fuels Economic Growth - January 29, 2026