Revitalizing Malawi’s Economy: Strategic Debt Solutions for Sustainable Growth

Key Business Points

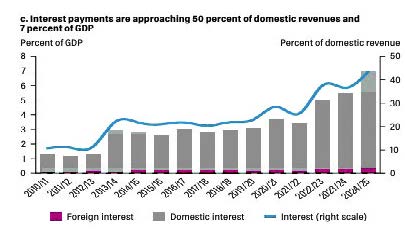

- Public debt restructuring is crucial for Malawi’s economic stability, with the country’s sovereign debt standing at roughly K16 trillion, about 86.4 percent of the country’s gross domestic product.

- Fiscal discipline is necessary to prevent a deeper crisis, as delaying debt reforms often leads to failed bond auctions, depleted reserves, and surging inflation, ultimately crowding out spending on essential services like health, education, and agriculture.

- Transparent negotiation with lenders is vital to protect local savers and ensure that any debt restructuring plan safeguards pensions and bank deposits, with every kwacha saved from debt payments going directly to critical services like medicines, seeds, and classrooms.

The recent International Monetary Fund (IMF) working paper, "Restructuring sovereign domestic debt in developing countries: New cases and lessons," has sparked renewed calls for public debt restructuring and fiscal discipline in Malawi. The paper warns that delaying decisive action on rising debt burdens can lead to costly consequences, including failed bond auctions, depleted reserves, and surging inflation. With Malawi’s sovereign debt at roughly K16 trillion, about 86.4 percent of the country’s gross domestic product, and interest payments consuming nearly half of all tax revenue, mkwapatira kwa nzeru (urgency) is necessary to address the issue.

Economists like Dalitso Kubalasa and Christopher Mbukwa are urging the government to take mkangano (action) to restructure the debt, citing the need to restore market confidence and prevent a deeper crisis. Kubalala likened Malawi’s debt position to "a family that has borrowed too much from loan sharks and is now drowning," emphasizing the need for transparent negotiation with lenders to protect local savers. Mbukwa noted that Malawi’s public debt has "already reached the distress level," calling for a coordinated approach that balances reform with financial stability.

The Reserve Bank of Malawi (RBM) has negotiated better debt restructuring terms with some lenders, but the process has been kugwiritsa ntchito (challenging). The IMF had set addressing unsustainable public debt as one of the prerequisites for its support, but the country’s debt profile now mirrors those pre-crisis economies. Economists say the government must combine fiscal consolidation with a carefully managed restructuring process to restore economic stability and ensure that resources are allocated to essential services. By taking a proactive approach to debt restructuring and fiscal discipline, Malawi can pangana za zikomo (achieve prosperity) and create a more stable economic environment for businesses and households to thrive.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Airtel Ignites Growth: Introducing Nzeru Fund to Fuel Malawi’s Business Revolution - January 10, 2026

- Revitalizing Malawi’s Economy: Opportunities for Private Sector Growth and Prosperity - January 10, 2026

- Malawi’s Economic Revival: SMEs Poised for Resurgence in 2026 - January 10, 2026