Fueling Growth Amidst Fiscal Challenges: Navigating Malawi’s Economic Landscape

Key Business Points

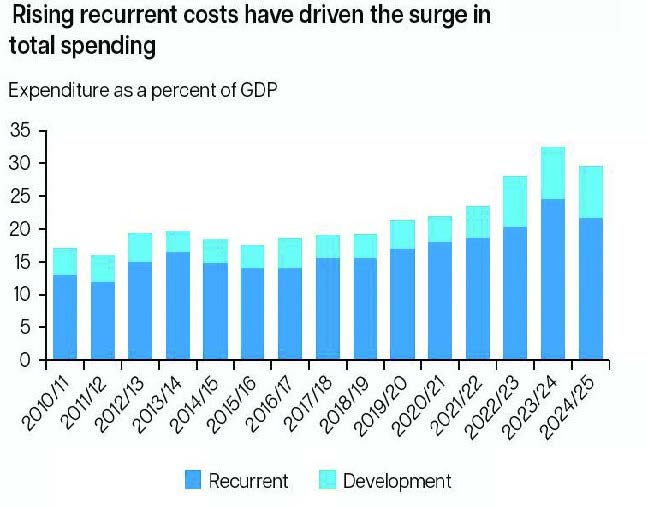

- Fiscal discipline is a major concern for Malawi’s business community, with government expenditure doubling from 16% to 31% of GDP between 2011/12 and 2024/25, outpacing regional averages.

- Rising interest payments and public wage bills are driving up recurrent spending, crowding out productive investment and undermining long-term growth prospects, with key rigid expenditures growing from 39% to almost 90% of domestic revenues.

- Development expenditure has been cut by K89.9 billion, impacting infrastructure and social services, while debt payments and wages have been revised upwards, highlighting the need for sustainable fiscal management.

Malawi’s business community is facing a challenging economic landscape, characterized by weak fiscal discipline and growing spending pressures. A recent World Bank analysis reveals that the country’s public spending as a share of GDP stands at 27.4%, exceeding the regional average of 23.3% and low-income country average of 27.3%. This surge in spending has been driven by a widening fiscal deficit, which has grown from 0.7% to 10.5% of GDP between 2011/12 and 2024/25.

The analysis highlights that rising interest payments and a growing public wage bill are major contributors to the increase in recurrent spending, constraining fiscal space and flexibility. These spending items reduce spending efficiency and crowd out productive investment, ultimately undermining long-term growth prospects. The interest bill, in particular, has risen sharply, reaching an estimated 7% of GDP in the 2024/25 financial year.

According to Treasury data, the 2025/26 revised National Budget indicates a 6.35% increase in total expenditure, with a 6.4% upward revision of wages and salaries and a K100 billion increase in debt payments. However, development expenditure has been cut by K89.9 billion, impacting infrastructure and social services. Scotland-based Malawian economist Velli Nyirongo notes that when a large share of revenue is allocated towards recurrent and statutory obligations, there is little left for essential investments.

In the 2025/26 Mid-Year Budget Review Statement, Minister of Finance, Economic Planning and Decentralisation Joseph Mwanamvekha emphasized the need to align funding with available resources to minimize the gap between revenue and expenditure requirements. The cumulative deficit for this fiscal year is wider than expected, reaching K2.037 trillion by September, highlighting the need for sustainable fiscal management. As Malawi’s business community navigates this challenging economic landscape, ndalama za malawi (Malawi’s money) must be managed wisely to promote economic growth and development.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Unlocking Malawi’s Trade Potential: K411 Billion in Barriers Explained - February 28, 2026

- Malawi Secures K75bn Chinese Grant for Landmark Dual Carriageway - February 28, 2026

- Malawi’s Graphite Gateway: US Partnership Powers Opportunities - February 28, 2026