Malawi’s Fiscal Pivot: Government’s K348bn Treasury Bills Decision to Reshape Business Landscape

Key Business Points

- The Malawi Government has rejected Treasury bills (T-bills) bids for three consecutive weeks to reduce its appetite for high borrowing costs and prioritize fiscal consolidation and debt sustainability.

- The move aims to lower interest rates and reduce domestic borrowing, enabling banks to increase lending to the private sector, which could spur economic growth.

- The government’s strategy may lead to a shift towards long-term borrowing through Treasury notes, potentially making government securities less attractive to financial institutions and directing more funds towards the private sector.

The Malawi Government’s decision to reject T-bills bids is a deliberate move to induce a decline in interest rates and reduce domestic borrowing. According to Minister of Finance, Economic Planning and Decentralisation Joseph Mwanamvekha, the rejection is meant to cut interest rates, reduce domestic borrowing, and enable banks to increase their lending to the private sector. This strategy is expected to reduce the country’s debt burden and interest payment, ultimately guaranteeing increased private sector credit and potentially stimulating economic growth.

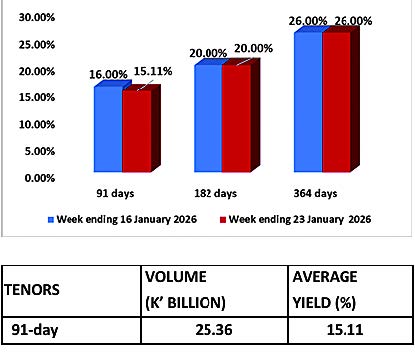

Reserve Bank of Malawi (RBM) spokesperson Boston Maliketi Banda explained that the government seeks to reduce its appetite for high borrowing costs amid elevated domestic debt levels, which currently stand at about K14 trillion, equivalent to 65 percent of the total public debt. By scaling back its participation in high-yield T-bills auctions, the government has effectively reduced demand for high-cost debt, leading to lower yields.

The move has been welcomed by business leaders, including Business Partners International country manager Bond Mtembezeka, who noted that the government’s strategy is synonymous with the current regime’s target to lower interest rates and exercise fiscal discipline. Financial Market Dealers Association president Leslie Fatch also observed that the high rejection of T-bills bids reflects efforts to reduce interests and the possibility of intention to shift towards long-term borrowing.

The trend in T-bills yield could result in a shift towards lending to the private sector as banks find T-bills less attractive. Market analyst Brian Kampanje noted that financial institutions might find government securities less attractive and instead invest in the private sector to stimulate production, create jobs, and earn more profits, leading to economic growth. Commercial banks have already slightly lowered their base lending rate to 25.2 percent in January 2026, following a decline in T-bills average yields.

In the 2025/26 National Budget, public debt interest is projected at K2.17 trillion, which is 8.4 percent of GDP and 49.2 percent of domestic revenues. As the government continues to prioritize fiscal consolidation and debt sustainability, businesses can expect a more favorable business environment with lower interest rates and increased access to credit. This development presents opportunities for local entrepreneurs to access funding and grow their businesses, contributing to the country’s economic growth and development.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Fiscal Pivot: Government’s K348bn Treasury Bills Decision to Reshape Business Landscape - January 26, 2026

- Revitalizing Malawi’s Economy: Harnessing Mining Wealth for Sustainable Growth - January 26, 2026

- Stabilizing Malawi’s Economy: Treasury Sets Record Straight on Tax Rumors - January 25, 2026