Malawi’s Market Momentum: Trading Trends to Watch in 2026

Key Business Points

- Investor sentiment remains cautious due to ongoing economic challenges, including high public debt and inflation pressures, affecting corporate earnings and investor confidence.

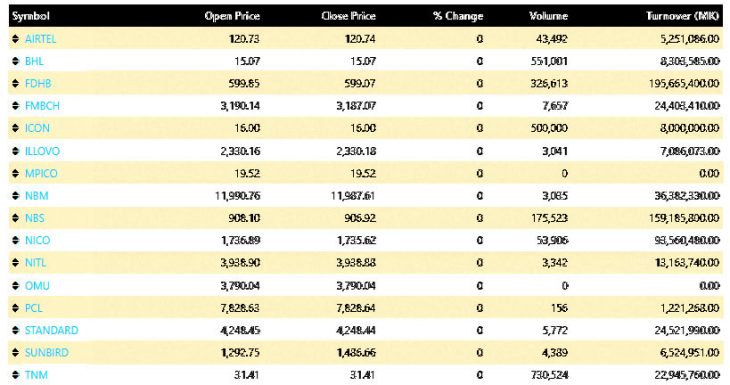

- Trading volumes declined significantly, with approximately 5.4 million shares changing hands compared to 24.7 million the previous week, indicating a slowdown in market activity.

- Market capitalisation stands at K32.8 trillion, reflecting the cumulative value of all listed companies, and presenting opportunities for zinthu zokwera (growth) and investment in the right sectors.

The Malawi Stock Exchange recorded a mixed performance in the second week of 2026, with some counters registering gains while others declined. Sunbird Tourism posted the strongest gain, closing at K1,486.66 from K977.50 the previous week, representing a 52 percent increase. This significant gain may be attributed to the company’s efforts to improve its services and attract more customers, a strategy that can be described as kutengera nthaka (expanding the market).

On the other hand, Press Corporation Limited experienced the steepest decline, falling to K7,828.64 from K8,728.11, a drop of approximately 10.3 percent. This decline may be a cause for concern for investors, highlighting the need for kuzipanga (planning) and strategic decision-making to mitigate risks.

Market analyst Brian Kampanje noted that the performance had been great in enabling shareholders to register massive capital gains in some counters and indeed enrich those who decided to dispose of partly or wholly on those counters. However, he also cautioned that some counters may be overvalued, and the best way to deal with that is to increase the number of shares through share splits or rights issue so that more shares are available to allow the shares to find their true value. This advice is crucial for investors looking to make informed decisions and kugwira ntchito (to work) towards maximizing their returns.

The mixed performance of the Malawi Stock Exchange reflects the current economic challenges facing the country, including high public debt and inflation pressures. As investors navigate these challenges, it is essential to remain wachikulu (vigilant) and adapt to the changing market conditions. By doing so, they can capitalize on opportunities for growth and investment, ultimately contributing to the country’s maendeleo (development) and economic prosperity.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Graphite Gateway: US Partnership Powers Opportunities - February 28, 2026

- Illovo Urges Forex Reforms to Fuel Malawi’s Economic Growth - February 28, 2026

- Lotus Saves K25bn with Landmark Grid Connection Deal - February 27, 2026