Malawi’s Microfinance Sector Faces Rising Bad Debt Burden: A Threat to Business Growth

Key Business Points

- Malawi’s microfinance sector is facing challenges with a surge in non-performing loans to 11.2 percent, up from 7.9 percent last year, due to borrowers struggling to service loans.

- High interest rates are affecting loan repayment, with some borrowers considering alternative lending options like village banks, as seen in the case of Martha Madengu, a single mother of three who sells charcoal in Lilongwe.

- Despite increasing non-performing loans, the subsector reported a profit of K6.6 billion, driven by improved earnings from institutions that registered trading losses in 2023, with total assets growing by 53.2 percent to K93.1 billion.

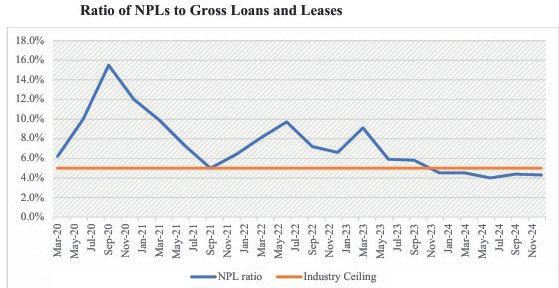

The microfinance sector in Malawi is grappling with the harsh economic environment, as borrowers struggle to service loans, leading to a significant increase in non-performing loans. According to the Reserve Bank of Malawi (RBM) Financial Sector Annual Report of 2024, the non-performing loans (NPL) ratio has risen to 11.2 percent, more than double the five percent regulatory benchmark. This is a concern for the asset quality of non-deposit-taking microfinance institutions.

The report highlights that gross loans increased to K70.7 billion from K42.8 billion in 2023, while NPLs rose to K7.9 billion from K3.4 billion in 2023. Financial analysts attribute the increasing NPLs to the lagged effects of the 44 percent kwacha devaluation in November 2023, which resulted in rising inflation and dampened the value of money. Kwacha devaluation has had a significant impact on the economy, making it difficult for borrowers to repay their loans.

The high interest rates charged by microfinance institutions are also affecting loan repayment. For example, Martha Madengu, a single mother of three who sells charcoal in Area 25 in Lilongwe, borrowed K300 000 from a savings and credit cooperative (Sacco) with an interest rate of above 30 percent. She finds it challenging to service the loan, saying it would be better to borrow from village banks. Muzungu ulibe, which means "high interest" in Chichewa, is a common concern among borrowers.

Despite the challenges, the subsector reported a profit of K6.6 billion, compared to a loss of K1.4 billion in 2023. Total assets also grew by 53.2 percent to K93.1 billion. The improvement was mainly driven by an improvement in earnings for institutions that registered trading losses in 2023. Return on asset and return on equity improved to seven percent and 19.4 percent respectively, as compared to negative 8.1 percent and negative 60.2 percent in 2023.

Financial experts, such as Booker Matemvu and Brian Kampanje, have expressed concerns about the increasing NPLs, attributing them to the high inflation rate and the preference of small and medium enterprises (SMEs) to borrow from microfinance institutions rather than commercial banks. Microfinance institutions (MFIs) play a critical role in boosting entrepreneurship, providing access to capital for small businesses, and promoting economic development. However, the increasing NPLs pose a risk to the stability of the sector.

To mitigate the effects of bad loans, the Malawi Union of Savings and Credit Cooperatives has adopted coping mechanisms, such as switching to short and medium-term loans from long-term loans. This allows members to access loans despite liquidity challenges. Kudziwa kwa mikolo, which means "coping mechanisms" in Chichewa, is essential for microfinance institutions to survive in the harsh economic environment. As the sector continues to face challenges, it is essential for stakeholders to work together to find solutions that will promote economic growth and development in Malawi.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026