Malawi’s Private Sector Surges: Credit Soars to 48.9% in Q3, Fueling Economic Growth

Key Business Points

- Private sector credit access has increased to 48.9 percent in Q3 2025, up from 26.3 percent in Q2, driven by seasonal trends and banks’ willingness to lend to firms.

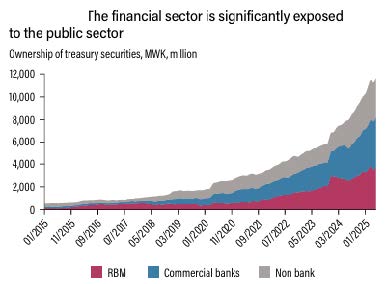

- Banks are shifting focus to private sector lending, with total credit to the domestic economy increasing to K10.6 trillion, driven by expansions in credit to the private sector and public non-financial corporations.

- Manufacturing sector credit has increased to 23.6 percent of total lending to the private sector, indicating a positive trajectory for the sector and opportunities for zinthu zopusazo (business growth) and kukongedwa kwa njira za ubwana (increased access to finance).

The recent Financial and Economic Review for Q3 2025 by the Reserve Bank of Malawi (RBM) reveals a significant increase in credit access for the private sector, with a year-on-year increase of 24.7 percentage points. This growth is attributed to mudzi wokongola (seasonal trends) and banks’ willingness to lend to firms. The private sector credit stood at K2.2 trillion in the quarter, with expansions registered in various sectors, including manufacturing, wholesale and retail, community, social and personal services, agriculture, forestry, fishing, and hunting.

According to economist Gilbert Kachamba, the growth in private sector credit suggests that banks are now more cautious about lending to government due to the high levels of domestic debt. Instead, they are opting to lend to the private sector, which can provide a more manageable risk. Brian Kampanje, a financial market analyst, describes the increased private sector credit as positive, noting the improved credit access by key sectors such as manufacturing. He highlights that credit to the manufacturing sector increased from 20.7 percent to 23.6 percent of the total lending to the private sector.

The RBM Governor, MacDonald Mafuta Mwale, has emphasized the importance of kuwongolera kwa kuthandiza (credit reporting) and asset-based lending in accelerating private sector credit access. This initiative aims to address the challenges of access to capital by allowing businesses to borrow using movable assets such as livestock or vehicles. This development is expected to boost production and kuletsa mabizinesi (grow businesses) in Malawi. As Charity Mughogho, head of personal and private banking at Standard Bank plc, notes, balancing government lending with customer loans is crucial to ensuring a healthy loan book. With the private sector credit on an upward trend, wabizinesi (business owners) and entrepreneurs in Malawi can explore opportunities for growth and expansion, leveraging the increased access to finance to drive their mabizinesi (businesses) forward.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Corporate Giants Surge: Record K1.5tn Profit Fuels Economic Growth - January 29, 2026

- Market Turbulence: Navigating Malawi’s Fiscal Shift and Its Impact on Business Growth - January 28, 2026

- FDH Delivers Record K50bn Payout, Fueling Malawi’s Economic Growth - January 28, 2026