Mitigating Risk in Malawi’s Economy: Navigating the Surge in Non Performing Loans

Key Business Points

- Higher impairment charges by commercial banks in Malawi are reducing net income and straining capital adequacy, which may lead to tighter lending standards and risk-based pricing.

- Tighter borrowing procedures could result in fewer individuals and businesses qualifying for loans, slowing economic growth and excluding vulnerable groups from financial support.

- Diversifying credit sources and accessing grants are crucial for small and medium enterprises (SMEs) to navigate the challenging economic environment and avoid high interest rates or foreclosure.

The Bankers Association of Malawi (BAM) has expressed concern over the increasing impairment provisions for commercial banks in the first half of 2025. According to BAM chief executive officer Lyness Nkungula, macroeconomic challenges are straining borrowers’ repayment capacity, leading to higher impairment charges. This trend may result in tighter lending standards and risk-based pricing, favoring lower-risk borrowers. Nkungula warned that this could lead to reduced access to credit, slowing economic growth, and excluding vulnerable groups from financial support.

The unpublished unaudited financial results for banks in the six-month period to June 2025 reveal that borrowers are struggling to service their loans. For instance, Standard Bank plc reported a 166 percent increase in credit impairments, while National Bank of Malawi plc saw a 51 percent growth in credit impairment charges. FDH Bank plc and NBS Bank plc also reported significant increases in credit losses and impairment provisions, respectively.

The Malawi Union of Small and Medium Enterprises president, James Chiutsi, noted that increased credit impairment makes it difficult for SMEs to access loans from banks or risks accessing credit at high interest rates. Chiutsi advised SMEs to diversify credit sources and access grants to navigate the challenging economic environment. The Consumers Association of Malawi executive director, John Kapito, echoed this concern, stating that the impairments increases are happening at a time when the economy shows no signs of growth.

According to Velli Nyirongo, a Scotland-based Malawian economist, the figures reflect a systemic challenge rather than isolated cases, signaling that credit risk has increased across the board. Nyirongo emphasized the importance of prudent financial management and proactive engagement with lenders for borrowers to navigate this environment. He also stressed the need for strengthening financial literacy to enable borrowers to better understand interest rate risks and make informed decisions on new credit commitments.

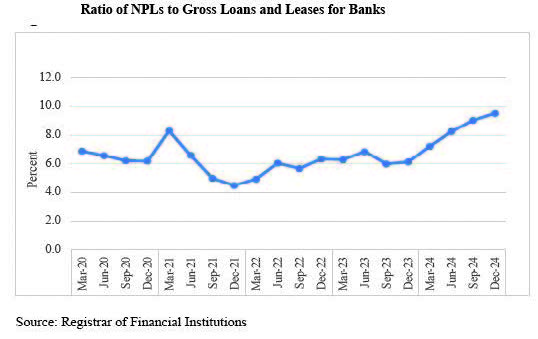

The Reserve Bank of Malawi data reveals that the non-performing loans (NPLs) ratio for banks rose to 9.5 percent as of December 2024, above the regulatory threshold of five percent. This was driven by a 98 percent increase in NPLs, outpacing the 25.1 percent growth in gross loans. The RBM attributed this to macroeconomic challenges, including the after-effects of the November 2023 44 percent kwacha devaluation and inflation, which weakened borrowers’ capacity. As the economy continues to face challenges, Ndalama za kuwongolera (financial management) and kuwongolera bwino (prudent management) will be crucial for businesses and individuals to navigate the uncertain environment.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026