RBM’s Strategy to Cement Forex Momentum: A Game Changer for Malawi’s Business Landscape

Key Business Points

- The Reserve Bank of Malawi (RBM) is implementing a multi-pronged strategy to protect foreign exchange reserves and stabilise the kwacha as the tobacco marketing season comes to a close, which is crucial for sustaining foreign exchange gains.

- The central bank has introduced measures such as reducing the mandatory export surrender requirement and introducing an electronic foreign exchange tracking system to enhance market integrity and incentivise production.

- The government is also working to diversify exports and expand access to regional markets through the National Export Strategy II, which prioritises high-potential non-traditional exports such as macadamia, sugar, and ethanol.

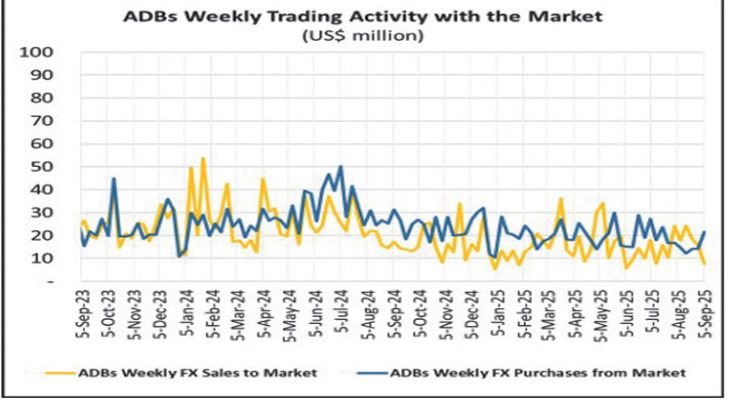

The Reserve Bank of Malawi (RBM) has announced plans to devise a strategy to protect foreign exchange reserves and stabilise the kwacha as the tobacco marketing season draws to a close. According to RBM spokesperson Boston Maliketi Banda, the measures are aimed at sustaining the improved external position seen in July, when the country’s trade deficit narrowed to $173 million, the lowest in months, and total foreign exchange reserves climbed to $607.7 million, equivalent to 2.4 months of import cover. Zikhala za mpango za RBM, or the central bank’s plan, is focused on structural reforms and enhanced market integrity.

The central bank has reduced the mandatory export surrender requirement from 30 percent to 25 percent to incentivise production and introduced an electronic foreign exchange tracking system to curb illicit trading. Additionally, the RBM is formalising mineral revenue streams and linking financial institutions with the private sector to finance export-oriented production. These measures are designed to shift Malawi’s foreign exchange management from dependence on seasonal inflows to a more durable foundation, ultimately supporting a stable exchange rate and a gradual strengthening of the country’s import cover position.

However, economists warn that without structural reforms, Malawi risks seeing the trade deficit widen again once the tobacco season ends. Kugawa kwa malonda, or the trade deficit, has been a concern for the country, with a cumulative trade deficit of $1.6 billion recorded between January and June 2025, a 15 percent rise from the same period in 2024. The government is working to address this issue through the National Export Strategy II, which prioritises high-potential non-traditional exports and aims to guide the transition away from tobacco dependence.

The Ministry of Trade and Industry is actively negotiating market access under regional trade agreements and has signed agreements with countries such as China and India for crops such as macadamia, soybeans, groundnuts, and pigeon peas. These deals seek to guarantee predictable markets for Malawian exporters and generate sustainable forex earnings, which is crucial for kulipira kwa mitengo, or foreign exchange earnings. As the tobacco marketing season comes to a close, it is essential for businesses to consider ução za kifaisal, or financial management strategies, to navigate the potential challenges and opportunities ahead.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026