Reshaping Malawi’s Economic Landscape: Financing Opportunities Amidst Fiscal Challenges

Key Business Points

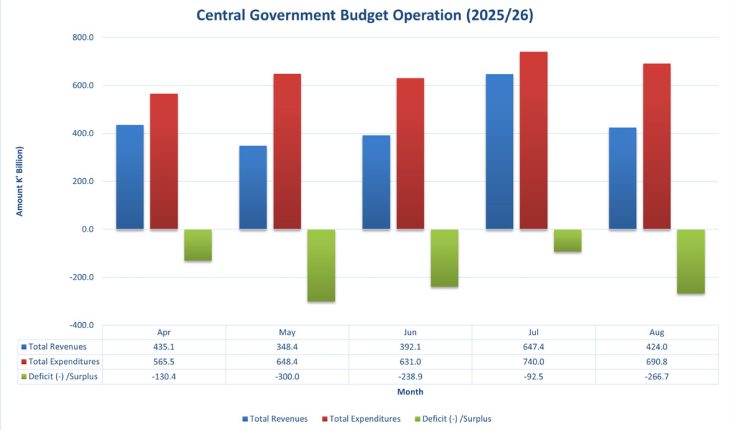

- Malawi’s fiscal deficit has widened to K1.03 trillion in the first five months of the fiscal year, with a significant gap between income and expenditure, highlighting the need for budget discipline and fiscal reforms.

- The government’s expenditure has consistently exceeded revenue, with a fiscal deficit of K1.03 trillion, prompting concerns about the impact on essential services such as health, education, and agriculture.

- Economists warn that the widening deficit could lead to higher interest rates and inflationary pressures, emphasizing the need for tangible reforms in budget management and transparency to restore credibility and rebuild fiscal buffers.

Malawi’s fiscal position is deteriorating, despite a higher revenue projection in the 2025/26 National Budget. The Treasury figures show a widening gap between income and expenditure in the first five months of the fiscal year, with cumulative revenues at K2.25 trillion against expenditure at K3.28 trillion. This creates a fiscal deficit of K1.03 trillion, meaning that for every kwacha collected, the government spent about K1.46. As Dr. Christopher Mbukwa, an economics lecturer at Mzuzu University, noted, "The problem is not only the amount spent, but how little flexibility the government has to scale down once the cycle begins."

The pattern reflects the combined effects of election-related spending, weak revenue performance, and structural rigidity in the budget. Agnes Nyirongo, economic governance officer at the Centre for Social Concern, described the imbalance as "a systemic fiscal crisis that demands urgent attention," linking the shortfall to election-period outlays and weak enforcement of spending limits. The approved 2025/26 National Budget set total expenditure at K8.05 trillion and, after appropriation, slightly raised total revenues and grants to K8.07 trillion, an almost balanced position on paper. However, actual performance since April points to continuing volatility, with increased fiscal deficit over the months.

Monthly receipts remain unstable, grant inflows have softened, and expenditure has consistently exceeded K565 billion, according to Treasury data. In August, revenue fell sharply while spending stayed high at K690.8 billion, widening the gap nearly threefold from the previous month. An economist who did not want to be named argued that restoring credibility will require tangible reforms in budget discipline and transparency. Velli Nyirongo, a Scotland-based Malawian economist, cautioned that the widening gap could prompt the government to resort to more domestic borrowing, potentially leading to higher interest rates and worsening inflationary pressures.

The challenge now extends beyond balancing monthly books to rebuilding fiscal buffers and aligning recurrent spending with sustainable financing. For policymakers, the near-term goal is to halt the slide that re-emerged in August without undermining service delivery. As mbirimano za mphato (business owners) and wauzimu (entrepreneurs) in Malawi, it is essential to monitor the fiscal situation closely and adjust malipo (payment) plans and mpango wa bijinesi (business plans) accordingly. The fiscal year’s budget projected a fiscal deficit of K2.47 trillion or 9.5 percent of the gross domestic product, which will be primarily financed through domestic borrowing amounting to K2.33 trillion and foreign borrowing of K145.78 billion, according to Treasury figures.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Navigating Malawi’s Fiscal Crossroads: Strategies for Business Resilience Amidst Rising Debt - January 29, 2026

- ACE Africa Taps Seasoned Expert Muona to Spearhead Growth and Drive Business Momentum in Malawi - January 29, 2026

- Navigating Turbulence: How Fuel Price Volatility Impacts Malawi’s Business Landscape - January 29, 2026