Revitalizing Malawi’s Economy: Overcoming Challenges for Sustainable Business Growth

Key Business Points

- Microeconomic challenges are eroding gains from investments, with the country’s average inflation rate of 32 percent significantly reducing real returns on investments.

- Sound investments can still achieve strong returns, with the financial sector counters on the Malawi Stock Exchange driving positive performance in 2024.

- Sustainable investment strategies are crucial in growing pension funds and retaining their value amidst economic shocks, with a focus on MPIKA MMOYENI (long-term investment) and беременности MWALIMU (diversification) being key.

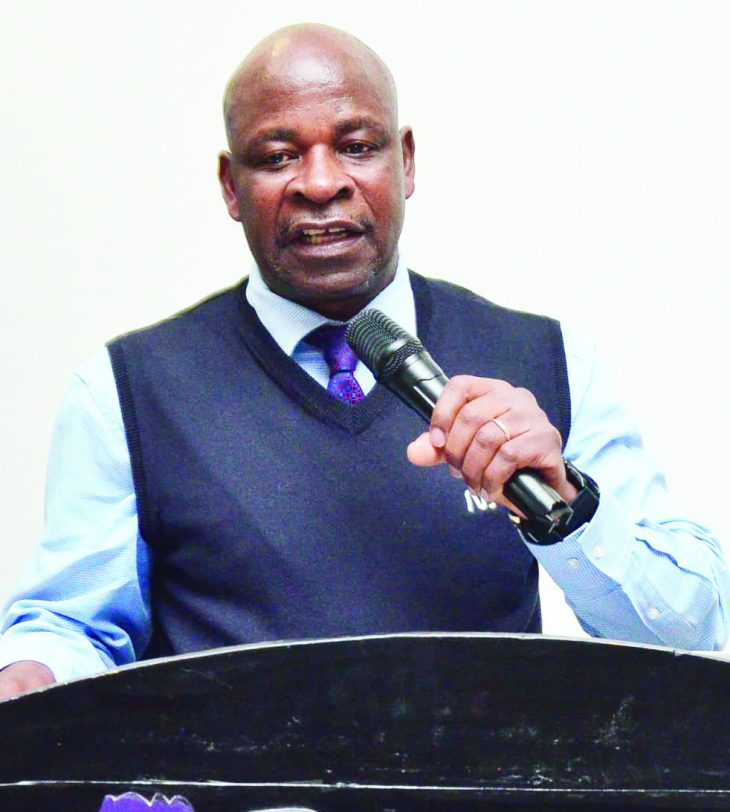

The Malawian economy is facing significant challenges, with an acute shortage of foreign exchange contributing to high inflation and affecting businesses’ ability to achieve real returns on investments. According to William Mabulekesi, Chief Executive Officer of NBM Pensions Administration Limited, the fund posted a nominal return of 34.5 percent in 2024, but the country’s average inflation rate of 32 percent during the same period significantly eroded gains, leaving a real return of just 2.5 percent. Mabulekesi noted that the challenging operating environment is affecting companies and employers, leading to rising default rates in pension remittances.

Despite these setbacks, NBM Pensions Administration has continued to make sound investments, achieving strong returns largely driven by the positive performance of financial sector counters on the Malawi Stock Exchange in 2024. Mabulekesi emphasized that the institution’s investment income has outpaced inflation, ensuring that members enjoy a real return that translates into meaningful growth of pension funds. This is particularly important for mwana wandale (business owners) and entrepreneurs who are looking to grow their investments and secure their financial future.

Nenauthe Nkoloma, Business Development Manager at NBM Capital Markets Limited, cited high inflation, currency depreciation, and market volatility as major challenges facing the investment climate. However, she assured pension clients that the institution is committed to growing their funds through SUSTAINABLE INVESTING STRATEGIES, ensuring that pension funds retain their value and are not eroded by economic shocks. This approach is in line with the concept of KUPEZA KWA MZANU (patience and perseverance), which is essential for long-term investment success.

The Pension Engagement Forum provided a valuable opportunity for attendees to engage with industry experts and learn about the latest trends and strategies in pension fund management. Wisdom Mpinganjira, HR Business Partner at Nacala Logistics, described the forum as valuable and expressed satisfaction with the fund’s ability to achieve above-inflation returns in 2024. As the Malawian economy continues to face challenges, it is essential for businesses and entrepreneurs to stay informed and adapt to the changing market conditions, focusing on (MPIKA MMOYENI) and UMOYO WAM’PANGO (prudent investment). By doing so, they can navigate the challenges and capitalize on opportunities for growth and development, ultimately contributing to the country’s economic growth and stability.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Kanyika Niobium Mine Breaks Ground: Fuelling Malawi’s Business Growth - February 12, 2026

- RBM Tightens Grip: K145bn Treasury Decision Impacts Malawi’s Economic Landscape - February 11, 2026

- Malawi Entrepreneurs: Scale Your SME, Strengthen the Economy - February 10, 2026