Treasuries’ Heavy Rollovers: How Malawi Businesses Can Mitigate Rising Borrowing Costs

Key Business Points

- High borrowing costs in Malawi are driven by the government’s reliance on debt rollovers, keeping Treasury yields high and squeezing space for cheaper private sector lending.

- The wide interest rate spread of about 33 percentage points is the widest among selected regional peers, making it challenging for businesses to access affordable credit.

- Fiscal consolidation is crucial to reducing government borrowing, improving inflation expectations, and creating a more favorable business environment, as emphasized by the Economics Association of Malawi president, Bertha Bangara-Chikadza, who notes that "kugawa kwa chiponde cha fedha" (fiscal discipline) is essential for economic growth.

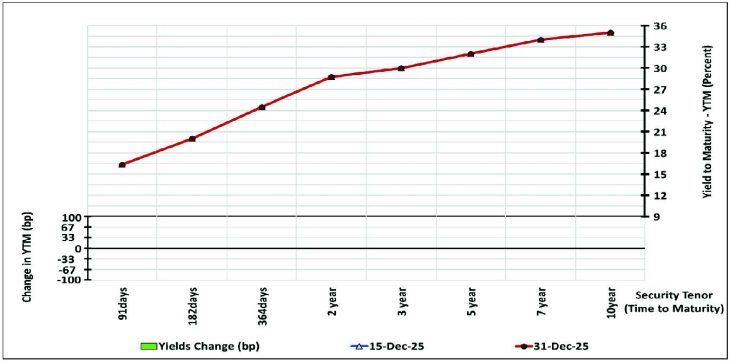

Malawi’s business community is facing significant challenges due to the government’s high borrowing costs, which are driven by its reliance on debt rollovers. According to the Reserve Bank of Malawi, at least K415 billion in Treasury securities are falling due in January 2026, with further maturities lined up for February and March. To refinance these obligations, the government will need to repeatedly tap into the domestic market, sustaining demand for bank liquidity and anchoring yields at high levels. This has resulted in a steep yield curve, with 91-day Treasury bills yielding about 16.3 percent, 364-day bills around 24.5 percent, and 10-year government bonds hovering near 35 percent.

The elevated yields have a direct impact on borrowing costs across the economy, with average lending rates around 37.3 percent, while depositors earn roughly 4.3 percent. This has created a wide interest rate spread, making it challenging for businesses to access affordable credit. As Velli Nyirongo, a Scotland-based Malawian economist, notes, "High public debt and dependence on domestic borrowing expose the economy to shocks, especially when export demand weakens and access to concessional financing tightens." Nyirongo also highlights the need for **"kuziba kwa mapiri" (fiscal prudence) to mitigate these risks.

The banking system is also affected, with high-yield government paper remaining attractive and offering predictable, low-risk returns. This has encouraged banks to allocate surplus liquidity to sovereign assets rather than to private sector lending. As a result, private sector credit has fallen, with a decline of K35.6 billion month-on-month to K2.2 trillion, driven mainly by declines in commercial and industrial loans and foreign-currency loans. Phillip Madinga, president of the Bankers Association of Malawi, notes that the wide interest rate spread reflects systemic pressures rather than isolated bank pricing, and emphasizes the need for **"ufumu wa chipani" (collaboration) between government, regulators, and stakeholders to address these challenges.

To address these challenges, fiscal consolidation is crucial, as it would reduce government borrowing, improve inflation expectations, and create a more favorable business environment. By prioritizing fiscal discipline and reducing its reliance on domestic borrowing, the government can help create a more stable and attractive environment for businesses to thrive. As the Economics Association of Malawi president, Bertha Bangara-Chikadza, notes, "tiyeni tigwiritse ntchito chipani cha fedha" (let us work together to promote fiscal discipline) to drive economic growth and development in Malawi.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.