Accelerating Capital Growth: Fueling Malawi’s Economic Prosperity

Key Business Points

- Business capital growth in Malawi has significantly decelerated to 5% in 2020 from 23% in 2017, primarily due to macroeconomic instability, highlighting the need for entrepreneurs to adapt to the changing economic landscape.

- Access to credit remains a major challenge for micro, small, and medium enterprises (MSMEs), with only 10% of medium enterprises, 5% of small enterprises, and 3% of microenterprises having access to credit from commercial banks, emphasizing the importance of mbawa za mikandamo (access to finance) for business growth.

- Financial inclusion is crucial for inclusive growth, with the Malawi Financial Inclusion Strategy aiming to reduce financial exclusion from 12% to 5% by 2028, underscoring the potential for uzwego wa kifоружi (financial inclusion) to drive economic growth and job creation.

Malawi’s business sector is facing significant challenges, with growth in business capital decelerating substantially from 23% in 2017 to 5% in 2020. According to the African Development Bank (AfDB), macroeconomic instability, including high inflation, large fiscal and current account deficits, high costs of credit, and shortages of foreign currency, has contributed to this decline. Furthermore, vulnerability to climate change and other external shocks has also had a detrimental impact on the country’s economy. As a result, business capital remains a relatively small component of national wealth, accounting for only 2% compared to 15% for Sub-Saharan Africa in 2020.

The AfDB report notes that this limited contribution reflects the dominance of micro and small enterprises engaged primarily in low-capital activities, which require minimal investment. Many MSMEs struggle with start-up costs, access to credit, and tax requirements, making it difficult for them to access finance and grow their businesses. In fact, the private sector credit to GDP ratio in Malawi is low, at 1.8%, compared to 67.6% in South Africa and 12.8% in Zambia. This highlights the need for ngalibele za kif∨zi (credit facilities) that cater to the needs of MSMEs.

Despite these challenges, MSMEs play a vital role in Malawi’s economy, with over 1.6 million MSMEs employing around 80% of the total labor force and contributing approximately 40% to GDP. However, only a small percentage of these enterprises have access to credit from commercial banks, with banks not prioritizing SME-friendly product portfolios due to government borrowing providing steady business. The Malawi Union of MSMEs has emphasized the need for concessionary risk and ample grace periods to support small businesses, as businesses take time to develop and grow.

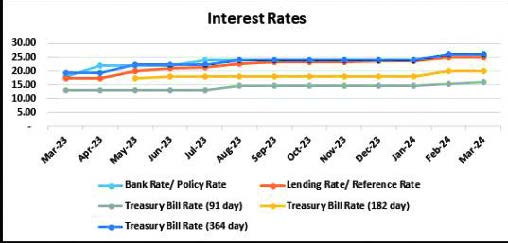

The Malawi Confederation of Chambers of Commerce and Industry (MCCCI) has also highlighted the impact of the unchanged policy rate of 26% on businesses, making it difficult for them to access affordable credit for investment and expansion. To address these challenges, the Malawi Financial Inclusion Strategy aims to reduce financial exclusion and support job creation, with a focus on increasing agriculture and small enterprises production and eventually increasing household income, reducing poverty, and accelerating economic growth. By kuchita kwa pamoja (working together), stakeholders can help create an environment that supports the growth and development of MSMEs, driving economic growth and prosperity in Malawi.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026