Closing Malawi’s Fiscal and Trade Deficits: Strategies for Business Growth and Economic Revitalization

Key Business Points

- Malawi’s government operations faced a revenue drop of 19.9% in May, resulting in a deficit of K300 billion, with declines in taxes, non-tax revenue, and grants being the main contributors.

- The country’s trade deficit has worsened, with imports reaching $314.6 million in May, while exports were only $250.1 million between January and May, leading to a cumulative trade deficit of over $1 trillion.

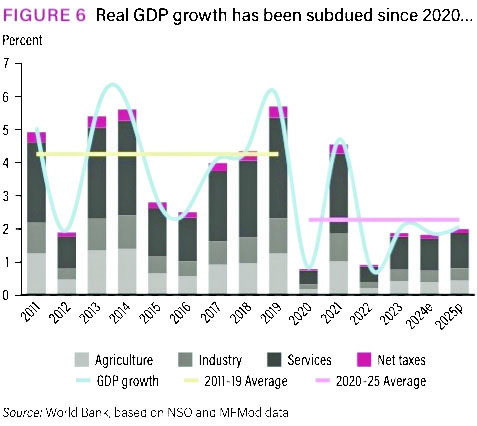

- The World Bank has identified policy misdirection, including price control, trade restrictions, and excessive domestic borrowing, as major factors affecting Malawi’s economic productivity and growth, with the country’s annual average growth rate dropping to 2.2% between 2020 and 2025.

The Reserve Bank of Malawi (RBM) has released its monthly economic review for May, which shows a significant decline in government revenue. The revenue drop, combined with increased expenditure, has resulted in a deficit of K300 billion, more than double the previous month’s figure. This is a cause for concern for Malawi’s business community, as it may lead to increased borrowing and higher interest rates, making it more difficult for businesses to access credit.

The trade situation is also a major concern, with imports significantly higher than exports. The trade deficit has worsened, with the country’s cumulative international goods trade resulting in a deficit of over $1 trillion. This is a significant challenge for Malawi’s economy, as it may lead to foreign exchange shortages and inflationary pressures. As one economist noted, "Kukwaniritsa kwa chikwama cha trade deficit kunali kufela mphamvu zathu za ku importinga zinthu" (The worsening trade deficit is weakening our ability to import goods).

The World Bank has also released its bi-annual Malawi Economic Monitor (MEM), which highlights the country’s economic challenges. The report notes that Malawi is suffering from policy misdirection, including price control, trade restrictions, and excessive domestic borrowing. These policies have affected productivity and economic growth, with the country’s annual average growth rate dropping to 2.2% between 2020 and 2025. This is below the average population growth rate of 2.6%, making the poverty profile deteriorate.

The foreign reserve position is also not improving, with the economy having only $521 million in reserves, equivalent to 2.1 months of import cover. This is a significant decline from the previous year, when the economy had $591 million in reserves. Economist Dalitso Kubalasa has urged the authorities to stop borrowing for consumption and increase investments in productive sectors, while allocating more resources to social sectors such as health and education to ensure human capital development. As he noted, "Tikwanire kuipa zinthu zofunika kwa sekita za uboma ndi umoyelo, kuti tigwiritse ntchito za malo ake" (We need to allocate resources to the productive sectors and stop borrowing for consumption, so that we can create jobs and stimulate economic growth). Local entrepreneurs and business owners should take note of these challenges and opportunities, and consider diversifying their investments and expanding their markets to stay competitive in the current economic environment.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026