Malawi’s Economic Surge: MSE Leads Africa’s Market Momentum in 2025

Key Business Points

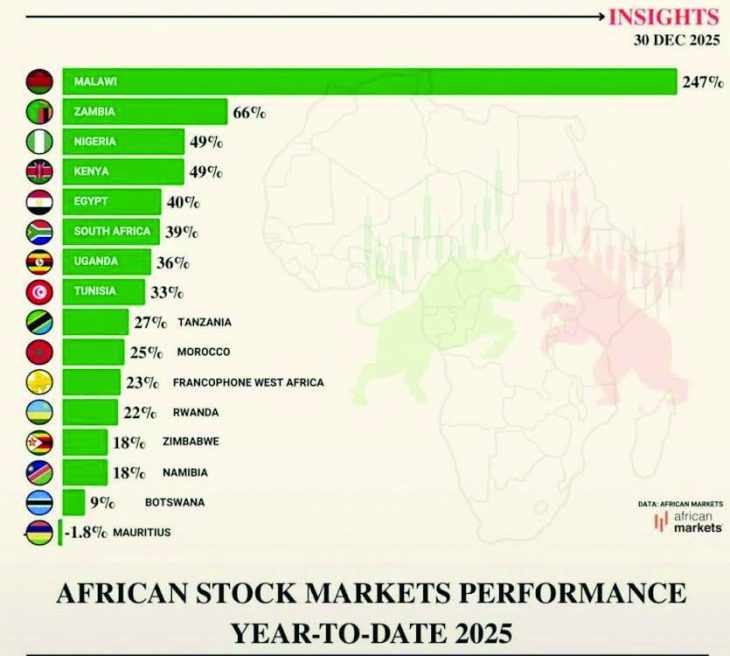

- The Malawi Stock Exchange (MSE) has emerged as Africa’s best-performing stock market in 2025, with a 247 percent year-to-date gain, driven by strong domestic investor demand and robust corporate earnings.

- The market capitalisation of the MSE has risen sharply to K32.6 trillion, exceeding 100 percent of Malawi’s nominal gross domestic product (GDP), with solid fundamentals boosting investor confidence.

- Despite the strong performance, investors are advised to look beyond headline index gains and focus on company fundamentals, diversification, and sound risk management to navigate the market in 2026.

The Malawi Stock Exchange (MSE) has made history by becoming Africa’s best-performing stock market in 2025, with a remarkable 247 percent year-to-date gain. This achievement is a testament to the strong performance of listed companies, underpinned by solid fundamentals that have boosted investor confidence. According to MSE Chief Executive Officer John Kamanga, the market index has risen by over 260 percent year-to-date, driven by strong domestic investor demand and robust corporate earnings.

The market capitalisation of the MSE has risen sharply to K32.6 trillion, up from K12.1 trillion in 2024, exceeding 100 percent of Malawi’s nominal gross domestic product (GDP). This growth can be attributed to investors seeking to preserve value amid high inflation and a lack of attractive alternative investments. As Kondwani Makwakwa, Stock Brokers Malawi Business Development Manager, noted, "Malawi’s market is relatively small, which means that when demand rises, share prices can increase significantly." Makwakwa also cited robust corporate earnings, particularly in the banking and financial services sector, as a key factor supporting the market’s performance.

The banking sector has benefited from high interest rates, which have improved their interest margins and profitability, strengthening investor confidence in the sector. However, Makwakwa advised investors to look beyond headline index gains and focus on company fundamentals, diversification, and sound risk management to navigate the market in 2026. With only 16 listed companies, the MSE remains among the smallest bourses in Africa, but its strong performance has made it an attractive destination for investors seeking growth opportunities. As Makwakwa said, "It is encouraging that most listed companies continue to report solid profits, which provides some fundamental support to these valuations." Kuzipanga zinthu (planning for the future) is crucial for investors to make informed decisions and capitalize on the opportunities presented by the MSE.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- New Visions for Progress: Charting Malawi’s Next Generation Economic Growth - February 13, 2026

- Kanyika Niobium Mine Breaks Ground: Fuelling Malawi’s Business Growth - February 12, 2026

- RBM Tightens Grip: K145bn Treasury Decision Impacts Malawi’s Economic Landscape - February 11, 2026