Managing Monetary Momentum: Navigating Inflation Risks in Malawi’s Growing Economy

Key Business Points

- Increased money supply: Malawi’s broad money supply has risen for six consecutive months, driven by robust growth in term deposits, demand deposits, and foreign currency deposits, which may lead to heightened inflationary pressures.

- Government borrowing: The growth in money supply is attributed to increased government borrowing, which may stimulate production but also has the potential to elevate demand and affect inflation rates.

- Inflation risks: Experts warn that the country risks exacerbating rising prices if authorities fail to match the growth in money supply with increased production, disproportionately affecting rural and small-income households.

Malawi’s economy is experiencing a significant increase in broad money supply, with a recorded growth rate of 52.1 percent in August 2025, according to the Reserve Bank of Malawi (RBM). This growth is driven by an increase in term deposits, demand deposits, and foreign currency deposits, which has been largely attributed to increased government borrowing. The RBM report highlights that the contribution of net credit to central government to the annual growth rate of money supply has increased, leading to a rise in broad money supply.

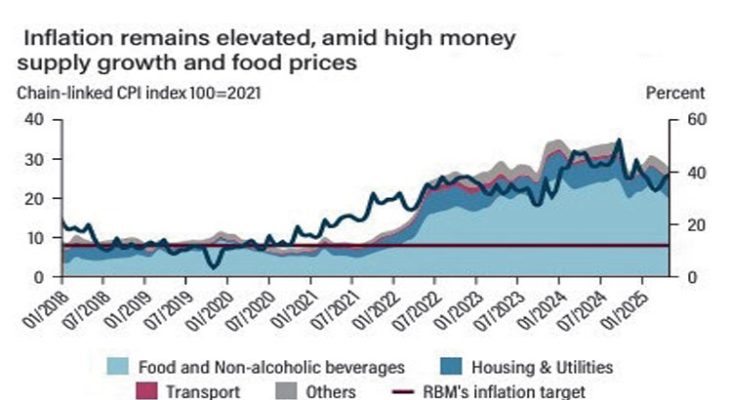

Experts, including University of Malawi macroeconomics lecturer Edward Leman, have expressed concerns that the growth in money supply may lead to inflationary pressures, as it fuels demand and creates a situation where too much money is chasing too few goods, resulting in higher prices. Leman notes that while money supply growth can stimulate production, it has the potential to elevate demand and affect inflation rates, currently at 28.2 percent as of August 2025. This situation is further complicated by the fact that many individuals and firms are digging deeper into their savings to afford goods and services amid the cost of living crisis and general inflation, injecting more money into circulation and increasing supply.

Finance expert Brian Kampanje links the increased government spending and borrowing associated with election spending during the campaign period to the growth in money supply, citing the expansionary fiscal policy adopted towards the September 2025 General Election. This excess liquidity has fueled demand-pull inflation, leading to dwindling living standards of the general populace, especially those in rural areas. The situation has also exerted pressure on the foreign currency exchange rate on the black market.

Scotland-based Malawian economist Velli Nyirongo warns that the country risks exacerbating rising prices if authorities fail to match the growth in money supply with increased production. This scenario disproportionately affects rural and small-income households, whose incomes are fixed and usually spend a higher proportion of their earnings on essential goods. As the RBM forecasts the inflation rate to average 28.5 percent by the end of the year, lending rates for commercial banks remain elevated, with high-risk borrowers attracting interest rates of as high as 36 percent. The situation highlights the need for zinthu zosiyanasiyane (sound economic management) to mitigate the effects of inflation and ensure tsogolo lathu (our future) is secure.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Navigating Malawi’s Fiscal Crossroads: Strategies for Business Resilience Amidst Rising Debt - January 29, 2026

- ACE Africa Taps Seasoned Expert Muona to Spearhead Growth and Drive Business Momentum in Malawi - January 29, 2026

- Navigating Turbulence: How Fuel Price Volatility Impacts Malawi’s Business Landscape - January 29, 2026