Navigating Turbulence: Strategies for Malawi Businesses to Thrive Amidst Economic Fluctuations

Key Business Points

- High inflation rates have persisted in Malawi, with the cost of living increasing significantly, affecting both households and businesses, with a K2,000 being able to buy less than half of what it could in January 2025 by December.

- Tight monetary policy has been implemented by the Reserve Bank of Malawi, with a policy rate of 26 percent, one of the highest on the continent, aiming to curb inflation, but resulting in expensive credit conditions for small and medium-sized enterprises.

- Economic hardships have been cited as a key concern, influencing political debates, with food insecurity remaining a critical issue, and an estimated 2 to 2.49 million people requiring humanitarian food assistance during the January to March 2026 lean season, affecting mfumukazi (households) across Malawi.

The year 2025 has been challenging for consumers in Malawi, with inflation rates persistently high, eroding households’ purchasing power. The cost of living has increased significantly, with the price of basic staples outpacing wage growth, leaving many families struggling to afford basic necessities like chakudya (food), maphunziro (education), and zimalonda (healthcare). According to recent data, a household of six requires an income of around K974,000 to afford basic needs, an astronomical figure for most of the population.

The Reserve Bank of Malawi has maintained a tight monetary policy stance, with the policy rate held at 26 percent, to curb inflation. However, this has resulted in expensive credit conditions for small and medium-sized enterprises, which are critical for employment. These enterprises have cited weak demand and high input costs as significant challenges, affecting their zochitika (profitability). In contrast, financial institutions have remained profitable, despite the economic hardships.

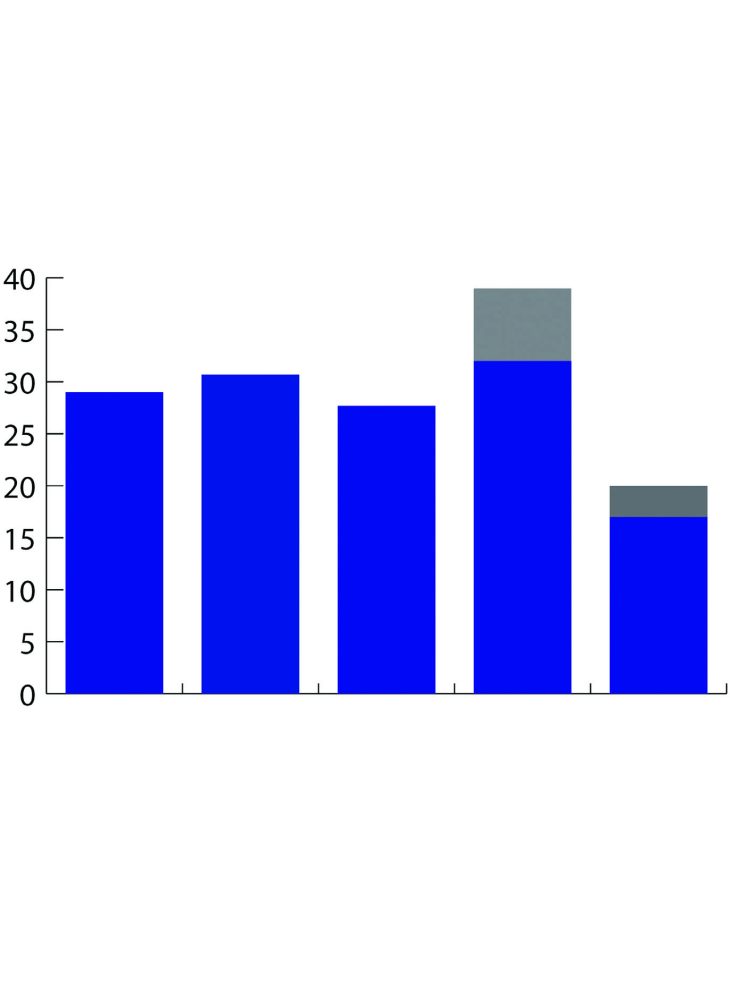

The economic hardships have been widely cited as a key concern, influencing political debates during the campaign. The rising cost of living has also echoed through the economy, with firms reporting higher input costs and tighter profit margins. The government has projected annual inflation to average 28.5 percent in 2025, slightly below the IMF projections, and a decline from 2024’s annual average of 32.3 percent. However, it remains to be seen whether this will materialize, and inflationary pressure still bites, eroding purchasing power and increasing the cost of doing business.

In the short term, the government is optimistic of a further annual inflation decline to 20.7 percent in 2026. However, this will depend on various factors, including the global economy and domestic policies. As it stands, inflationary pressure still poses a significant challenge to mfumukazi (households) and businesses in Malawi, affecting their zimalonda (wellbeing) and zochitika (profitability). It is essential for wobwela (entrepreneurs) and akuluakulu (business leaders) to stay informed and adapt to the changing economic landscape to remain competitive and profitable.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Business Pulse: Falling Interest Rates Open New Avenues for Growth - February 8, 2026

- Malawi’s Growing Trade Gap: Key Challenges and Opportunities for Business Strategy - February 8, 2026

- Social Protection Funding Gap Hampers Malawi’s Economic Growth—Analysis - February 7, 2026