Reshaping Malawi’s Economic Future: A Call to Action for Informed Budget Reform

Key Business Points

- Restructure the 2025/26 Mid-Year Budget to restore stability and avoid destabilizing the economy, as the current fiscal path is fuelling inflation and eroding confidence, with a deficit of K1.36 trillion in just six months.

- Stop using domestic borrowing as the default solution to every fiscal gap, as it is leading to a "quiet but growing crowding-out crisis" that is choking private sector growth, with banks shifting away from private lending and toward government securities.

- Secure external budget support, such as an IMF programme, to restore policy credibility and halt deficit monetisation, as it is essential to break the debt-inflation loop and create space for policy intervention, with experts warning that "an IMF programme is not a luxury; it is a lifeline".

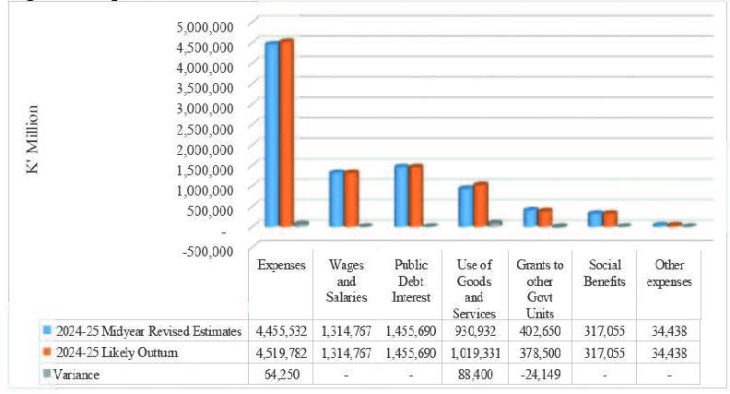

The Malawian economy is facing significant challenges, with inflation climbing to 29.1 percent and growth projections slipping to 2.4 percent. The current fiscal path is fuelling inflation, crowding out investment, and eroding confidence, with domestic borrowing reaching unprecedented levels. The Reserve Bank of Malawi (RBM) has reported a deficit of K1.36 trillion in just six months, from April to September 2025. Economist Bena Nkhoma warns that the situation is no longer just about borrowing, but about monetisation, which is inflationary by definition. He argues that the system is trapped in a cycle where deficits are driving liquidity, liquidity is fuelling inflation, and inflation is eroding confidence.

The Economics Association of Malawi (Ecama) president, Bertha Bangara-Chikadza, agrees that the mid-year review must repair the structural flaws in the budget itself, rather than just adjusting spending ceilings. She emphasizes the need to link recurrent spending to expected revenues and debt-service capacity, and to redirect borrowing toward productive sectors that can strengthen exports, employment, and revenue generation. This approach is in line with the Chichewa business principle of " Kulima kwa ajira" (farming for profit), which emphasizes the importance of investing in productive activities that generate income and create jobs.

The 2025/26 National Budget assumptions no longer hold, with inflation seven percentage points higher than projected and growth fallen nearly a full percentage point lower. Interest payments have exceeded K200 billion in some months, and grant inflows have remained irregular. The money supply is expanding at more than 50 percent year-on-year, driven by rising government borrowing and central bank financing. Nkhoma stresses that the mid-year budget review must acknowledge this new reality and focus on credibility rather than optimism, as the question now is not whether the budget is ambitious, but whether it is believable. If confidence is not restored, no amount of borrowing will be enough, and the economy risks being locked into a cycle where inflation, debt, and low growth reinforce each other. As Bangara-Chikadza warns, "Zinthu zinafika pachete" (things are reaching a critical point), and the choices made now will determine whether the economy stabilizes or sinks deeper into crisis.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- New Visions for Progress: Charting Malawi’s Next Generation Economic Growth - February 13, 2026

- Kanyika Niobium Mine Breaks Ground: Fuelling Malawi’s Business Growth - February 12, 2026

- RBM Tightens Grip: K145bn Treasury Decision Impacts Malawi’s Economic Landscape - February 11, 2026