Revitalizing Malawi’s Economy: Strategies to Overcome Inflation Challenges and Fuel Sustainable Growth

Key Business Points

- Monetary policy responses to high inflation in Malawi have been deemed insufficient by the International Monetary Fund (IMF), highlighting the need for more effective measures to control inflation.

- The Reserve Bank of Malawi (RBM) has maintained a policy rate of 26 percent, with the last hike occurring in February 2024, and has instead relied on increasing the liquidity reserve requirement (LRR) ratio to curb inflation.

- Economic experts are calling for a tight fiscal policy to match the tight monetary policy, emphasizing the need for reduced local market borrowing and unnecessary fiscal expenditures to sustain the downward trend in inflation, as emphasized by the Chichewa proverb "Kusintha kunama" (reducing debt is key to prosperity).

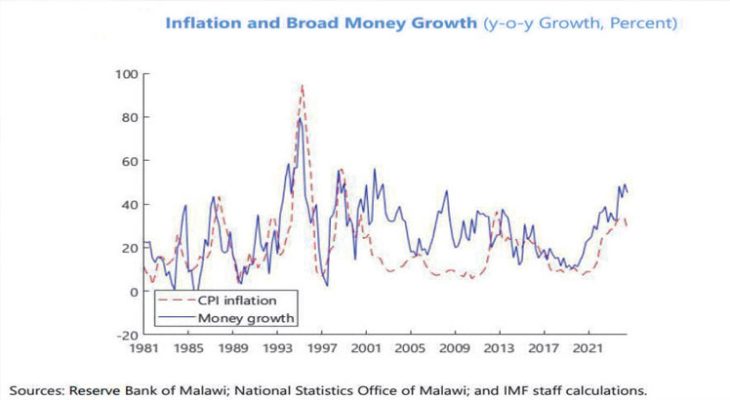

The International Monetary Fund (IMF) has expressed concerns that recent monetary policy responses to high inflation in Malawi have proven to be insufficient. Despite four monetary policy committee (MPC) meetings in 2024, the policy rate remained fixed at 26 percent, with the last policy rate hike of two percentage points occurring in February 2024. Instead, the authorities relied on increasing the liquidity reserve requirement (LRR) ratio for domestic currency deposits by 125 basis points in November 2024. However, broad money growth remained elevated, with year-on-year net claims on the government and credit to the private sector growth of 83 percent and 20 percent as of end-February 2025, respectively.

The IMF analysis notes that year-over-year inflation has stayed above 20 percent over the past three years, oscillating around 30 percent since end-2023. This sustained high inflation reflects ongoing economic challenges and pressures on prices. The seasonally adjusted month-on-month inflation has also shown a sharp upward trend since 2020, driven by both food and non-food inflation. As Gowokani Chijere Chirwa, associate professor of economics at the University of Malawi, observed, even though inflation is going down, high money supply and re-emerging maize price pressure still exert pressure on inflation outlook.

The Reserve Bank of Malawi (RBM) maintained the policy rate at 26 percent, the Lombard rate at 20 basis points above the policy rate, and the LRR at 10 percent for local currency deposits and 3.75 percent for foreign currency deposits. RBM governor MacDonald Mafuta-Mwale stated that the MPC acknowledged the decline in inflation from 30.7 percent in February to 27.1 percent in June 2025, but observed that the recent decline is not sufficient, hence the current stance is necessary to sustain the downward trend in inflation. Economic consultant Booker Matemvu emphasized the need for a tight fiscal policy to match the tight monetary policy, highlighting the importance of reduced local market borrowing and unnecessary fiscal expenditures, in line with the Chichewa phrase "Tikwaniritse" (let’s be cautious with our spending).

The RBM has revised upwards the 2025 annual average inflation rate forecast from 27.4 percent to 28.5 percent, citing persistent upside risks to food prices. The policy rate has been maintained at 26 percent for more than a year, leaving commercial banks’ borrowing rates as high as 36 percent. As businesses and entrepreneurs in Malawi navigate this economic landscape, it is essential to plan strategically, considering the potential impact of high inflation and interest rates on their operations and mitigating risks to ensure sustainable growth and profitability, while also keeping in mind the importance of "Kuthandiza ponse" (supporting each other) in times of economic uncertainty.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026