Clarification on Advance Income Tax

Hello everyone, as most of you know a new bill that a lot of us are simply calling “import tax” or “advance import tax” was approved by parliament on the 23rd of June 2021 but not without outcry from the general public especially on social media. The bill is confusing to just about everyone including some of the tax, import, procurement and auditing experts we have in Malawi. Luckily, the Ministry of Finance listened to the outcry and they have now released a document that clarifies and summarizes the new bill in a way that most of us now should understand what the bill is about and who it affects, either way, I can’t say I am personally happy about it because despite MRA collecting more and more taxes, can we really pinpoint to what these tax dollars of ours are being used for besides paying salaries? Anyway, below is the entire document or latter made by Ministry of Finance. Let us know what you think in the comments.

Hello everyone, as most of you know a new bill that a lot of us are simply calling “import tax” or “advance import tax” was approved by parliament on the 23rd of June 2021 but not without outcry from the general public especially on social media. The bill is confusing to just about everyone including some of the tax, import, procurement and auditing experts we have in Malawi. Luckily, the Ministry of Finance listened to the outcry and they have now released a document that clarifies and summarizes the new bill in a way that most of us now should understand what the bill is about and who it affects, either way, I can’t say I am personally happy about it because despite MRA collecting more and more taxes, can we really pinpoint to what these tax dollars of ours are being used for besides paying salaries? Anyway, below is the entire document or latter made by Ministry of Finance. Let us know what you think in the comments.

The Ministry of Finance wishes to clarify the provision of Taxation (Amendment) Bill No.13 of 2021 that was passed by Parliament on Wednesday 30th June 2021 in particular the ‘Advance Income Tax’.

This follows the misunderstanding and misinformation that ensued in the August House regarding the intent and structure of the tax.

The general public may wish to note that:

1. The Advance Income Tax has been introduced to encourage tax compliances and bring the informal sector into the tax net. However,

the publicist informed that small cross border traders are exempted from import taxes on consignments of goods up to US$3000. This is applicable through an already existing facility called “Simplified Trade Regime” which is being applied by the customs authorities in COMESA and SADC regions of which Malawi is a member.

2. The Advance income Tax is targeted at commercial imports and not imports for personal use; the tax will be collected at the point of entry into Malawi at the rate of 3% of the landed cost of imports(Value for Duty Purposes — VDP) and it is not a final tax which means, a tax refund will be given if the actual income tax paid ‘by the trader at the end of the year is more than the applicable (assessed) tax on the profits of the business. Compliant taxpayers who have either a Withholding Tax Exemption Certificate or a Tax Clearance Certificate will be exempted from the tax.

3. Once a tax payer files a return (submits their annual accounts), the advance income tax that was withheld by the Malawi Revenue Authority will be claimable by the tax payer as a tax credit. This means that the annual tax liability will be reduced by the advance income tax. If he paid more taxes than the annual tax liability, a tax refund will be given.

Further, the general public may wish to note that, the Advance Income Tax will not apply on:

- Goods imported for personal use. The nature and quantity of

goods as well as the frequency of importation will be used to

determine whether goods are for commercial use or for

personal use; - Imports by businesses that are tax compliant (businesses that

are registered with the MRA, file tax returns, and pay taxes on

time) will not be subjected to the Advance Income Tax

provided that the business has a Withholding Tax Exemption

Certificate or a Tax Clearance Certificate (TCC); - Imports by Government Ministries, Departments or Agencies;

and - Imports by any person that is exempt from income tax Under the

Taxation Act.

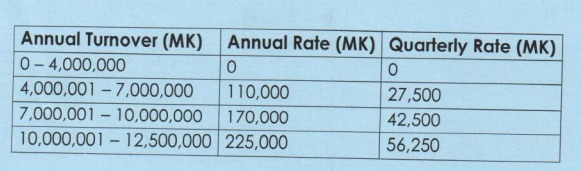

Small cross-border traders, whose turnover is below MK12.5 million per year, will be under the presumptive tax regime. As such, they will be required to pay their taxes as per the table below;

4. Once the small cross border traders have paid the presumptive tax, they would not be subject to the Advance Income Tax at the border since they will be issued with a Tax Clearance Certificate.

The Ministry would like to further inform the general public that the intent of the tax is to encourage every citizen to be duty bound to paying taxes and promote a culture of tax compliance amongst Malawians. It should be the duty of every economically active Malawian to contribute towards the national development agenda of the country. In that regard, it is not the intention of the Government to overload Malawians with punitive taxes as it may be perceived. Every citizen whose income graduates into the taxable income bracket should be encouraged to pay their fair share of tax to the Government accordingly.

The Ministry of Finance therefore greatly commends the August House for passing the Taxation (Amendment) Bill No. 13 of 2021 on Wednesday, 30th June 2021, which will anchor the implementation of the 2021/2022 Budget which was dully passed by the same Honorable House on 23rd June 2021.

For further details, please contact Mr. Williams Banda on 0993377777.

- The Hidden Costs of Sending Money Home: A Look into Malawi’s Remittance Rates - March 15, 2024

- Malawi Resumes Passport Printing: What You Need to Know - March 12, 2024

- Malawi’s Maize Prices Show Decline, Relief for Consumers - March 12, 2024