The Hidden Costs of Sending Money Home: A Look into Malawi’s Remittance Rates

- Malawi bets on diaspora for economic recovery with Diaspora Cities.

- High bank fees deter diaspora remittances, impacting economy.

- Solutions: Cap fees, encourage competition, boost mobile transfers.

Hello everyone, today we will discuss the recent news regarding the lack of funds coming in from the diaspora brought forth by Onjezani Kenani, a popular Malawian social media influencer who is currently based in the diaspora in Europe.

In a bid to jumpstart Malawi’s economic recovery, the government has placed a strategic bet on the financial muscle of its diaspora community. Remittances sent home by Malawians abroad are a crucial source of foreign exchange, and the recently announced “Diaspora Cities” by the Minister of Finance, Simplex Banda in initiative, aims to tap into this potential. This ambitious program promises Malawians living overseas a streamlined process to purchase plots in designated areas across four major cities. The vision extends beyond housing, with plans for these zones to boast enhanced social services like schools, clinics, and recreational facilities, all built with investor participation.

Malawi Diaspora Cities Planned

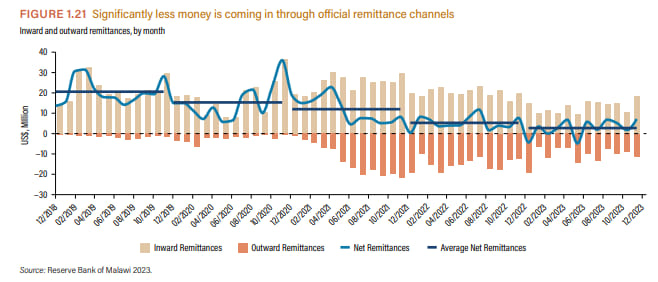

The government anticipates this initiative to generate a significant influx of foreign currency, estimated at K250 million annually. However, a cloud of uncertainty lingers. While the Diaspora Cities program seeks to attract substantial foreign investment, a critical question remains unaddressed, will it tackle the current frustrations faced by Malawian diaspora when sending money home through official channels? Let’s look at some of the data that the Reserve Bank of Malawi has recently released regarding this issue.

Reserve Bank of Malawi Diaspora Data for 2023

What does this chart mean?

This chart indicates that the money sent home from Malawians living abroad (inward remittances) is not as much as it used to be, and at the same time, more money is being sent out of Malawi (outward remittances). The brown bars below zero show that there are months where more money leaves the country than comes in. This situation might be concerning because many families in Malawi rely on money sent from relatives living overseas to help pay for essentials like food, school fees, and medical care. The blue line’s downward trend suggests that on average, this financial support from abroad is decreasing, which could lead to tighter household budgets and may affect the overall economy of Malawi, as less money coming in from abroad could lead to less spending and investment within the country.

Why are Malawians sending less money to Malawi?

Onjezani Kenani is quoted on his facebook post:

Three months ago, the Minister of Finance outlined recovery plans. A cornerstone of those plans was diaspora remittances. He touted, among other things, an initiative called diaspora cities. His vision was that this would yield $250 million a year. But the report from the Reserve Bank tells a story that is not aligned with that vision. The graph from the report, which I shared on my wall as well as on my Twitter account yesterday, has elicited comments from Malawians in the diaspora, most of whom feel robbed by extortionist rates in our commercial banks. I hope the ministries of finance and economic planning and also the central bank are listening.

Commercial banks are busy courting the diaspora, but they do so with words. The reality is that the official rates remain unrealistic and discourage remittances through formal channels.

Then, when home, try withdrawing money from an ATM with your foreign bank card. If the official rate is K1,757, the ATM will change you at K1,560 or thereabouts, and that’s before you factor in bank charges. As a result, many simply avoid coming anywhere near auto-teller machines with their foreign cards – and the nation loses out as a result.

There is a need to move on from mere sloganeering about diaspora remittances to tangible action on rates.

A major challenge for Malawians living abroad who want to send money back home is the excessive fees charged by commercial banks. As pointed out by Onjezani et al., these fees disproportionately burden the Malawian diaspora and hinder Malawi’s economic growth.

Sending money home should be a straightforward way for Malawians abroad to support their families and contribute to Malawi’s development. However, exorbitant bank charges eat into the intended amount, making it less attractive and affordable to send remittances. This discourages financial support from the diaspora, a critical source of income for many Malawian families.

How to solve this Diaspora issue?

The Reserve Bank of Malawi, the country’s central bank, and commercial banks have a responsibility to address this issue. Here are some possible solutions:

- Regulation: The Reserve Bank could implement regulations to cap/limit remittance fees, ensuring they are fair and transparent.(This is something they must do asap!)

- Competition: Encouraging competition among money transfer providers could drive down fees and benefit Malawian diaspora.

- Mobile Money Innovation: Promoting wider adoption of mobile money transfer services, which often have lower fees, can provide a more affordable option for Malawians abroad.

Are you a Malawian living abroad? Open a Diaspora Bank Account

What are Diaspora Accounts?

- National Bank of Malawi Diaspora Account

- Standard Bank of Malawi Diaspora Account

- FDH Diaspora Account

- NBS Diaspora Account

Benefits of opening a Diaspora account in Malawi

A lot of these accounts offer some good benefits, for example, National Bank of Malawi’s Diaspora account offers No e-service fees, Free internet banking, a higher credit interest rate on Malawi kwacha Savings account, 2% above normal savings ordinary rate.

NOTE: Make sure you give these banks an early notice(at least 7 days) according to NBS, otherwise you will be charge 40% interest. Wow, that is just insane to me but something to keep in mind. I am not sure about the other banks so make sure you enquire and at the same time, let us voice our opinion because that doesn’t seem right at all, regardless of whatever reasons they come up with.

Poll

Further Reading

- Read the Malawi Diaspora Engagement Policy

- Malawian Diaspora groups that you can join if you are in the United States

Please leave a comment below and let us and the Malawi government know about what you think about how the government can help increase the diaspora deposits.

- The Hidden Costs of Sending Money Home: A Look into Malawi’s Remittance Rates - March 15, 2024

- Malawi Resumes Passport Printing: What You Need to Know - March 12, 2024

- Malawi’s Maize Prices Show Decline, Relief for Consumers - March 12, 2024