Narrowing Fiscal Gaps: Strategies to Revitalize Malawi’s Tax Base and Stimulate Economic Growth

Key Business Points

- Malawi’s tax revenue contribution to the national budget has declined to 67 percent in the 2024/25 fiscal year, the lowest in recent years, affecting the government’s ability to fund public services and development projects.

- The reduction in tax revenue is attributed to economic challenges, including fluctuating donor funding and global economic uncertainties, as well as a zero tax rate policy for incomes below K1.8 million, which may not be effectively redistributing wealth.

- To address the decline, experts recommend strengthening tax enforcement, fostering a conducive business environment, and prioritizing essential expenditures to minimize wasteful spending and drive economic growth, which can be achieved through mkwapatira kwa chip soir (tightening the belt) and kuwongolera motse ( fiscal discipline).

Malawi’s tax revenue contribution to the national budget has been on a declining trend, with the 2024/25 fiscal year recording the lowest contribution at 67 percent. According to data from the Malawi Revenue Authority (MRA), tax revenue stood at K3.06 trillion out of the K4.55 trillion domestic revenue. This decline is a concern for the business community, as it affects the government’s ability to fund essential public services and development projects, which can impact the overall mphamvu ya uchumi (economic growth) of the country.

The MRA has made significant strides in enhancing tax collection efficiency and broadening the tax base, despite facing numerous economic challenges. The public tax collector is dedicated to optimizing revenue collection, supporting the country’s overarching development agenda as espoused under the Corporate Strategic Plan (CSP) 2020/26. Kutenga mapato (revenue collection) is a critical aspect of the government’s fiscal policy, and the MRA is committed to implementing robust revenue enhancement measures, ensuring strict taxpayer compliance and collection efficiency to meet revenue targets.

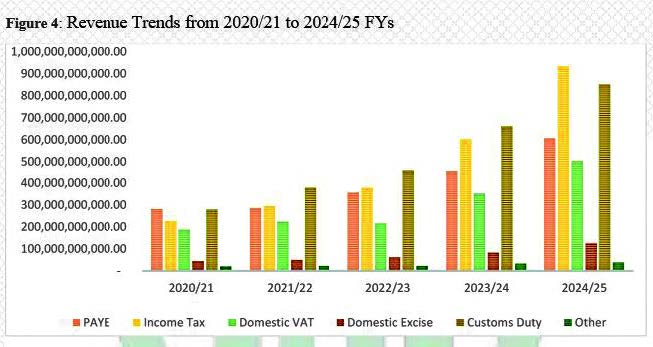

The data shows that domestic taxes collection amounted to K2.208 trillion, below the target of K2.377 trillion by K168.5 billion, representing a 93 percent performance. International trade taxes totalled K850.45 billion against a target of K1.04 trillion. Income tax was the major contributor to tax revenue in the 2024/25 fiscal year, followed by trade taxes, pay as you earn, domestic value added tax, and domestic exercise.

Experts have observed that economic challenges have negatively affected efforts to increase tax revenues. The zero tax rate policy for incomes below K1.8 million has also been criticized for not effectively redistributing wealth. Kusintha ndi kudz soir (fiscal discipline) is essential in addressing the decline in tax revenue, and experts recommend strengthening tax enforcement, fostering a conducive business environment, and prioritizing essential expenditures to minimize wasteful spending and drive economic growth.

The financial and insurance sector held the largest share of tax revenue, followed by manufacturing and wholesale and retail trade. The ratio of domestic revenue to gross domestic product has decreased from 18.1 percent in 2024/25 to 17.1 percent in 2025/26, below the 18.4 percent target set in the 2021/26 Domestic Revenue Mobilisation Strategy. This kukwata kwa msika (slowing down of economic growth) can have far-reaching consequences for the business community, and it is essential to address the decline in tax revenue to ensure sustainable economic growth and development.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026

- Navigating Malawi’s Fiscal Crossroads: Strategies for Business Resilience Amidst Rising Debt - January 29, 2026