Navigating Malawi’s Fiscal Landscape: Expert Insights on Public Debt and Economic Growth

Key Business Points

- Malawi’s public debt, currently estimated at 85-90% of GDP, poses significant risks to the country’s macroeconomic stability, particularly with pre and post-election spending and geopolitical factors on the horizon.

- Experts recommend fiscal consolidation and revenue mobilisation measures to contain the debt pressure, emphasizing the need for political parties to commit to debt management.

- The International Monetary Fund (IMF) warns that elevated debt levels represent a source of fragility, requiring immediate measures to avert a debt crisis, including sustained fiscal adjustment and new external concessional financing.

Malawi’s public debt situation is a growing concern, with the country’s debt estimated to be between 85 and 90 percent of gross domestic product (GDP). As of September 2024, the public debt stood at K16.2 trillion, representing 86.4 percent of GDP. This alarming trend has prompted warnings from the International Monetary Fund (IMF) and local experts, who cite pre and post-election spending and geopolitical factors as potential risks that could further exacerbate the situation.

According to Economics Association of Malawi (Ecama) Executive Director Esmie Kanyumbu, the debt situation is worrying, and it is essential to discuss and find solutions, particularly with the country heading towards elections. She emphasized the need for fiscal consolidation and revenue mobilisation measures to contain the debt pressure, saying "Kuzipanga.charset ndi kuyipanga" (planning and budgeting are crucial). Kanyumbu also stressed that the commitments made by political parties on debt management will be crucial in addressing the issue.

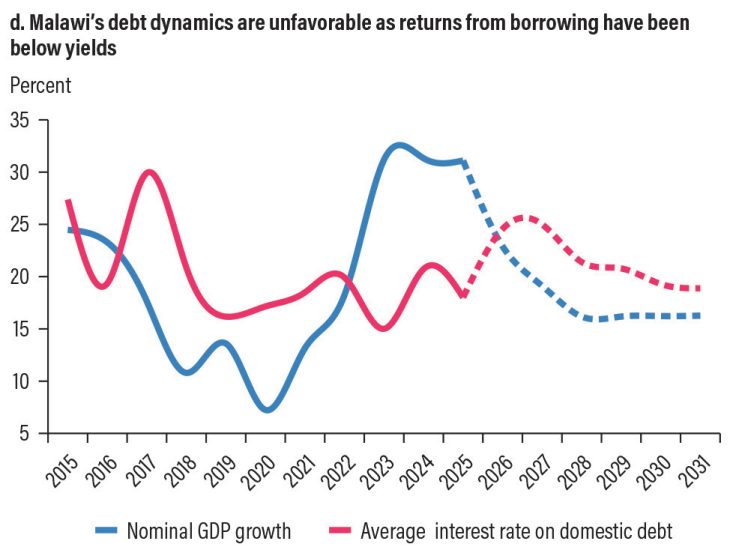

The IMF’s Article IV consultation report highlights the extent of debt stress, calling for immediate measures to avert the situation. The report notes that the recent increase in domestic debt poses broader risks to public debt and macroeconomic sustainability, with the stock of domestic public debt rising sharply in recent years and projected to continue rising under the baseline. The IMF warns that "Elevated debt levels represent a source of fragility" in the context of a shifting geopolitical landscape and Malawi’s vulnerability to shocks.

The report also discloses that there are outstanding arrears with commercial creditors worth $690 million at the end of 2024, while several breaches in debt burden were also evident, putting the debt-to-GDP ratio at 88 percent. To mitigate these risks, the IMF recommends a sustained medium-term macroeconomic adjustment and steps to substantially reduce the domestic interest bill, including through a sustained fiscal adjustment and new external concessional financing. As Malawi’s business community navigates this challenging economic landscape, it is essential to prioritize dfiri ndi mpango (prudence and planning) to ensure long-term sustainability and growth.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s Maize Price Slump: Strategic Response for Business Growth - February 6, 2026

- Malawi’s Agricultural Resource Imbalance: Economic Opportunities at Risk - February 6, 2026

- Empowering Malawi’s Future: Minister Fast Tracks Technical College Upgrades for Economic Growth - February 5, 2026