Revitalizing Malawi’s Economy: Capitalizing on Foreign Investment Opportunities to Drive Growth

Key Business Points

- Foreign investors are favoring neighboring countries over Malawi due to macro-economic instability, resulting in lower foreign direct investment (FDI) inflows.

- Infrastructure development is crucial to attracting investments, particularly in the transport and energy sectors, where Malawi is currently lacking.

- Policy coherence and economic growth are essential for creating an environment where FDI can flourish, and Malawi must prioritize these areas to become a more attractive investment destination.

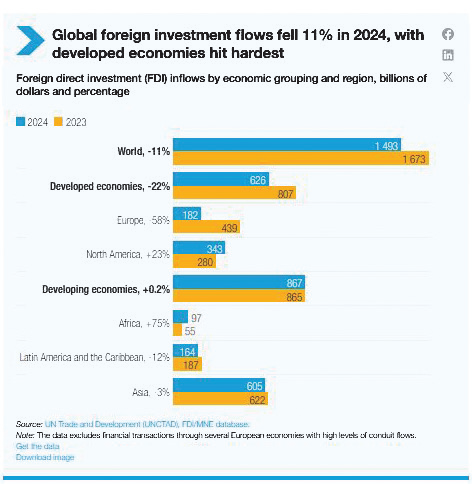

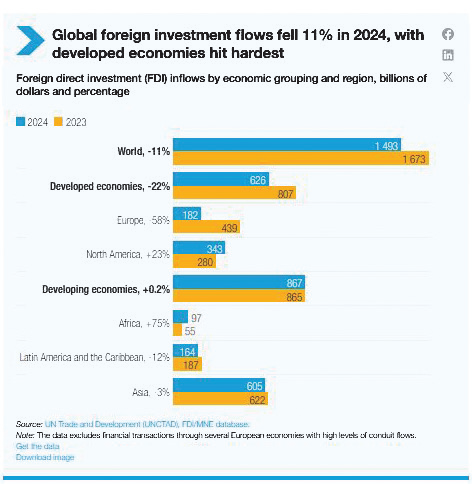

Malawi’s business community is facing a challenging environment, as foreign investors seem to be shunning the market in favor of neighboring countries. According to published data from the United Nations Conference on Trade and Development, FDI inflows to Malawi stood at $220 million in 2024, a rise from the previous year but still below regional neighbors. Mozambique, South Africa, Tanzania, Zambia, and Zimbabwe all attracted significantly more FDI, with Mozambique leading the pack at $3 553 million.

The Unctad secretary general, Rebeca Grynspan, notes that many economies are being left behind due to the ease of investment, rather than the need for it. She emphasizes the importance of aligning public and private investment with development goals and building trust into the system to bring scale, stability, and predictability to domestic and international markets. In Malawi, this means addressing the infrastructural needs in the transport and energy sectors, which are currently limiting investment.

The Malawi Investment and Trade Centre director general, Kruger Phiri, acknowledges that despite progress following some policy reforms, there is still much work to be done. He cites the low gross domestic product per capita as a setback, as it can deter investors. However, Phiri highlights the various policy reforms and initiatives aimed at promoting investments in manufacturing, mining, and value addition, such as the establishment of special economic zones and the agriculture, tourism, mining, and manufacturing (ATMM) strategy.

The National Working Group on Trade and Policy chairperson, Frederick Changaya, observes that while government has made efforts to build institutional frameworks supporting FDI attraction, more needs to be done to revolutionize policy coherence that supports general economic growth. He notes that FDI flourishes where there are growing and increasing returns. As the World Bank states in its June 2025 Global Economic Prospects, trade policy uncertainty and growing protectionism will likely weaken economic growth, compounding challenges to create sufficient employment for expanding working-age populations.

Absa Africa Financial Markets also notes that the continued shortage of foreign exchange is dampening Malawi’s potential to attract investors. For Malawian entrepreneurs and business owners, this means that kutengera kwa zipata (finding opportunities) and kufikira pamoja (thinking together) with government and other stakeholders is crucial to addressing these challenges and creating a more favorable investment environment. By prioritizing tsogolo la malawi (Malawi’s future) and working together to address these issues, Malawi can become a more attractive destination for foreign investors and drive economic growth.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Malawi’s K1.2tn Gold Smuggling Scourge: A Threat to Business Growth and Economic Stability - February 1, 2026

- Revitalizing Malawi’s Economy: Lower Food Prices Signal New Growth Opportunities - January 31, 2026

- Revitalizing Malawi’s Economy: Tackling Climate Related Underfunding for Sustainable Growth - January 30, 2026