Revitalizing Malawi’s Economy: Turning Deficits into Opportunities for Growth and Prosperity

Key Business Points

- Fiscal deficits are widening in Malawi, reflecting a mixture of structural and policy challenges, spending pressure, rigid recurrent commitment, and narrow revenue base, which have eroded fiscal stability.

- Debt management and expenditure control are crucial to prevent the deficit from widening further, as interest payments now consume more than K200 billion per month.

- Broader reforms are necessary to stabilize the fiscal path, including deeper reforms in tax administration, public finance management, and strict adherence to planned expenditure, to prevent persistent deficits from forcing higher domestic borrowing and crowding out private-sector credit.

The Malawian economy is facing significant challenges, with widening fiscal deficits posing a major concern for the business community. Economists have warned that the trend is increasingly dangerous and reflects structural weaknesses in the economy. The current financing model, driven by short-term domestic borrowing to cover recurrent costs, risks pushing Malawi into a debt-inflation loop. To stabilize the fiscal path, deeper reforms are necessary, including improvements in tax administration, public finance management, and strict adherence to planned expenditure.

The Economics Association of Malawi has cautioned that the budget has expanded rapidly without accompanying macro stability, highlighting the need for strict control over expenditure. Economist Gilbert Kachamba has warned that persistent fiscal gaps remain a major concern and could affect the budget implementation, while Scotland-based economist Velli Nyirongo has described the government’s decision to freeze new hires and promotions as a necessary but insufficient step toward stabilization.

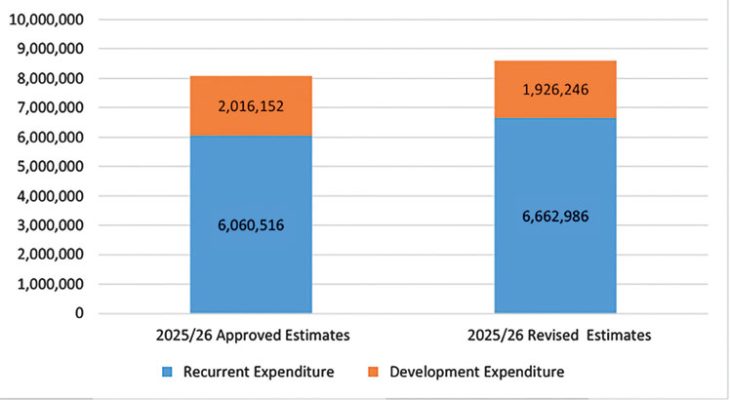

According to Treasury figures, revenue gains recorded in October were strong enough to reverse widening gaps between income and expenditure since April, but the broader trend remains unchanged. The cumulative deficit from April to October exceeds K1.23 trillion, with domestic revenue and grants underperforming by 43 percent and 12 percent, respectively. The Mid-Year Budget Review Statement has revised the projected deficit from K2.498 trillion to K3.128 trillion, an expansion of 25.2 percent.

As the fiscal year approaches its end on March 31, 2025, business owners and entrepreneurs must be aware of the potential risks and opportunities arising from the current economic situation. The kwacha may be subject to inflationary pressures, and interest rates may rise, affecting borrowing costs and credit availability. To navigate these challenges, businesses must zitengera dzanja (be vigilant) and khonza malo (be proactive) in managing their finances and seeking opportunities for growth. By understanding the ndalama za fkono (economy’s dynamics) and zipatala za boma (government’s policies), businesses can make informed decisions to mitigate risks and capitalize on emerging opportunities.

What are your thoughts on this business development? Share your insights and remember to follow us on Facebook and Twitter for the latest Malawi business news and opportunities. Visit us daily for comprehensive coverage of Malawi’s business landscape.

- Navigating the Pinch: How Soaring Fuel Costs Are Reshaping Malawi’s Business Landscape - January 24, 2026

- Expanding Opportunities: MBS Enhances Accreditation to Fuel Malawi’s Economic Growth - January 24, 2026

- Revitalising Malawi’s Building Sector: A New Era of Compliance and Opportunity - January 24, 2026